Although you don’t have to take the CMA Part 1 first, passing both parts of the CMA exam is the first and most crucial step to becoming a CMA.

Since each part covers different topics, it’s important that you study for each part separately. If you decide to start with CMA Part 2, study and pass the exam before starting on Part 1 content. I recommend using a solid CMA exam study guide and spending at least 16 weeks preparing for each part.

This article will give you a crash course on what to expect on CMA Part 1, starting with syllabus and exam topics. You’ll also find a simple study plan to get started.

Read on for everything you need to know to start preparing for the CMA Exam Part 1 and pass it on your first attempt.

Originally published in 2012, this article was updated and republished on March 13, 2024.

CMA Part 1 Syllabus

This comprehensive CMA Part 1 course outline covers all six exam topics, including external financial reporting decisions, planning and budgeting, performance management, cost management, internal controls, and technology and analytics.

The CMA exam is difficult, no doubt about it. The sheer quantity of content spanning both parts can be a little overwhelming. It is definitely a benefit that it is broken up the way it is.

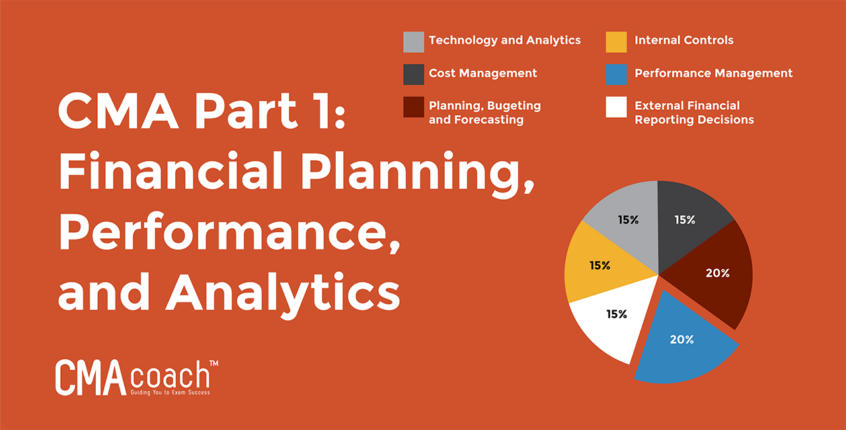

The CMA syllabus for Part 1 covers the following:

- External Financial Reporting Decisions (15% of your score)

- Planning, Budgeting and Forecasting (20% of your score)

- Performance Management (20% of your score)

- Cost Management (15% of your score)

- Internal Controls (15% of your score)

- Technology and Analytics (15% of your score)

In order to do well, you’ll need to exercise the following skills:

- Knowledge

- Comprehension

- Application

- Analysis

- Synthesis

- Evaluation

Keep in mind that the CMA exam requires a higher level of thinking than just reciting facts or working with basic equations. You’ll need to demonstrate the skills listed above in each knowledge area on the test.

Pro tip: Our expert-designed study guides help you master the core CMA subject matter, like financial statements, performance measures, and internal controls.

Let’s dive deeper into what you need to learn for those topics.

CMA Exam Part 1 Topics: Financial Planning, Performance and Analytics

Some of these topics may be familiar to you if you’ve completed an accounting degree before going after the CMA. Since there’s also a CMA experience requirement, some candidates already have practical knowledge of a few of these topics.

Even so, you’ll need to spend time reviewing everything and make sure you not only know the material, but can apply your knowledge under pressure.

Here is a further breakdown of each topic area, with a reminder of their percentage for relative weight range:

A. External Financial Reporting Decisions – 15%

This section of the CMA largely deals with financial statements for accounting information. External financial reports are viewed by people outside an organization, so they have to align with specific requirements.

Pro tip: Our comprehensive study modules allow you to dive deep into external financial reporting decisions, which make up a crucial 15% of the CMA Exam Part 1.

They may be prepared by accountants within a reporting entity and are usually some type of disclosure, statement, or summary. You’ll need a fairly thorough knowledge of external financial reporting and financial statements for this section of the CMA exam.

Financial Statements

For the balance sheet, income statement, statement of changes in equity, and the statement of cash flows, you should be able to:

- Identify the users of these financial statements and their needs

- Demonstrate an understanding of the purposes and uses of each statement

- Identify the major components and classifications of each statement

- Identify the limitations of each financial statement

- Identify how various financial transactions affect the elements of each of the financial statements and determine the proper classification of a given transaction

- Demonstrate an understanding of the relationship among the financial statements

- Demonstrate an understanding of how a balance sheet, an income statement, a statement of changes in equity, and a statement of cash flows (indirect method) are prepared

With respect to consolidated financial statements prepared under U.S. GAAP, the candidate should be able to:

- Define consolidated financial statements

- Define the two types of consolidation models: variable interest entity model and voting interest model

- Demonstrate an understanding of the three types of consolidation accounting: full consolidation, proportionate consolidation, and equity consolidation

- Demonstrate an understanding of intracompany balances and transactions that should be eliminated in consolidation

With respect to integrated reporting, the candidate should be able to:

- Define integrated reporting, integrated thinking, and the integrated report, and demonstrate an understanding of the relationship among them

- Identify the primary purpose of integrated reporting

- Explain the fundamental concepts of value creation, the six capitals, and the value creation process

- Identify elements of an integrated report (i.e., organizational overview and external environment, governance, business model, risks and opportunities, strategy and resource allocation, performance, outlook, and basis of preparation and presentation)

- Identify and explain the benefits and challenges of adopting integrated reporting

Recognition, Measurement, and Valuation

You should feel comfortable with:

Asset Valuation

- Identify issues related to the valuation of accounts receivable, including timing of recognition and estimation of the allowance for credit losses

- Distinguish between receivables sold (factoring) on a with-recourse basis and those sold on a without-recourse basis, and determine the effect on the balance sheet

- Identify issues in inventory valuation, including which goods to include, what costs to include, and which cost assumption to use

- Identify and compare cost flow assumptions used in accounting for inventories

- Demonstrate an understanding of the lower of cost or market rule for LIFO and the retail inventory method, and the lower of cost and net realizable value rule for all other inventory methods

- Calculate the effect on income and on assets of using different inventory methods

- Analyze the effects of inventory errors

- Identify advantages and disadvantages of the different inventory methods

- Recommend the inventory method and cost flow assumption that should be used for a company given a set of facts

- Demonstrate an understanding of the following debt security types: trading, available-for-sale, and held-to-maturity

- Demonstrate an understanding of the valuation of debt and equity securities

- Determine the effect on the financial statements of using different depreciation methods

- Recommend a depreciation method for a given set of data

- Demonstrate an understanding of the accounting for impairment of long-term assets and intangible assets, including goodwill

Valuation of Liabilities

- Identify the classification issues of short-term debt expected to be refinanced

- Compare the effect on financial statements when using either the assurance warranty approach or the service warranty approach for accounting for warranties

Income taxes (applies to Assets and Liabilities subtopics)

- Demonstrate an understanding of interperiod tax allocation/deferred income taxes

- Distinguish between deferred tax liabilities and deferred tax assets

- Differentiate between temporary differences and permanent differences, and identify examples of each

Leases (applies to Assets and Liabilities subtopics)

- Distinguish between operating and finance leases

- Recognize the correct financial statement presentation of operating and finance leases

Equity transactions

- Identify transactions that affect paid-in capital and those that affect retained earnings

- Determine the effect on shareholders’ equity of large and small stock dividends, and stock splits

Revenue recognition

- Apply revenue recognition principles to various types of transactions

- Demonstrate an understanding of revenue recognition for contracts with customers using the steps required to recognize revenue

- Demonstrate an understanding of the matching principle with respect to revenues and expenses, and be able to apply it to a specific situation

Income measurement

- Define gains and losses, and indicate the proper financial statement presentation for gains and losses

- Demonstrate an understanding of the treatment of gain or loss on the disposal of fixed assets

- Demonstrate an understanding of expense recognition practices

- Define and calculate comprehensive income

- Identify the correct treatment of discontinued operations

GAAP – IFRS differences

Major differences in reported financial results when using GAAP vs. IFRS and the impact on analysis:

- Identify and describe the following differences between U.S. GAAP and IFRS: expense recognition, with respect to share-based payments and employee benefits; intangible assets, with respect to development costs and revaluation; inventories, with respect to costing methods, valuation, and write-downs (e.g., LIFO); leases, with respect to lessee operating and finance leases; long-lived assets, with respect to revaluation, depreciation, and capitalization of borrowing costs; and impairment of assets, with respect to determination, calculation, and reversal of loss

B. Planning, Budgeting and Forecasting – 20%

This section of the CMA will test your ability to blend accounting concepts with practical skills in finance. This is where you will demonstrate the high-level strategy skills Certified Management Accountants are known for in planning, budgeting, and forecasting.

A lot of the study you will do for this section will require you to work through financial scenarios using sound budgeting and accounting principles.

This section makes up 20% of CMA Part 1 and covers six areas of competency.

Strategic Planning

In this section, you will need to understand everything that goes into strategic planning, such as:

- Discussing how strategic planning determines the path an organization chooses for attaining its long-term goals, vision, and mission, and distinguish between vision and mission

- Identifying the time frame appropriate for a strategic plan

- Identifying the external factors that should be analyzed during the strategic planning process and understanding how this analysis leads to the recognition of organizational opportunities, limitations, and threats

- Identifying the internal factors that should be analyzed during the strategic planning process and explaining how this analysis leads to the recognition of organizational strengths, weaknesses, and competitive advantages

- Demonstrating an understanding of how an organization’s mission leads to the formulation of long-term business objectives, such as business diversification, the addition or deletion of product lines, or the penetration of new markets

- Explaining why short-term objectives, tactics for achieving these objectives, and operational planning (master budget) must be congruent with the strategic plan and contribute to the achievement of long-term strategic goals

- Identifying the characteristics of successful strategic plans

- Describing Porter’s generic strategies, including cost leadership, differentiation, and focus

- Demonstrating an understanding of the following planning tools and techniques: SWOT analysis, Porter’s Five forces, situational analysis, PEST analysis, scenario planning, competitive analysis, contingency planning, and the BCG Growth-Share Matrix

Budgeting Concepts

Not to be confused with budgeting methodologies, the budgeting concepts included are:

- The role that budgeting plays in the overall planning and performance evaluation process of an organization

- The interrelationships between economic conditions, industry situation,

- and an organization’s plans and budgets

- The role that budgeting plays in formulating short-term objectives and in planning and controlling operations to meet those objectives

- The role that budgets play in measuring performance against established goals

- The characteristics that define successful budgeting processes

- The budgeting process facilitates communication among

- organizational units and enhances coordination of organizational activities

- The concept of a controllable cost as it relates to both budgeting and performance evaluation

- The efficient allocation of organizational resources is planned during the budgeting process

- The appropriate time frame for various types of budgets

- Who should participate in the budgeting process for optimum success

- The role of top management in successful budgeting

- The use of cost standards in budgeting

- Differentiate between ideal (theoretical) standards and currently attainable (practical) standards

- Differentiate between authoritative standards and participative standards

- The steps to be taken in developing standards for both direct material and direct labor

- The techniques that are used to develop standards, such as activity analysis and the use of historical data

- The importance of a policy that allows budget revisions that accommodate the impact of significant changes in budget assumptions

- The role of budgets in monitoring and controlling expenditures to meet strategic objectives

- The role of budgetary slack and its impact on goal congruence

Forecasting Techniques

Make sure you brush up on the following to tackle this section:

- Demonstrate an understanding of a simple regression equation

- Define a multiple regression equation

- Calculate the result of a simple regression equation

- Demonstrate an understanding of learning curve analysis

- Calculate the results under a cumulative average-time learning model

- Identify the benefits and shortcomings of regression analysis and learning curve analysis

- Calculate the expected value of random variables

- Identify the benefits and shortcomings of the expected value technique

- Use probability values to estimate future cash flows

Budgeting Methodologies

There are many different ways to budget. Make sure you understand the difference between:

Annual business plans (master budgets)

Project budgeting

Activity-based budgeting

Zero-based budgeting

Continuous (rolling) budgets

Flexible budgeting

You will be tested on the following competencies related to budgeting methods:

- Define its purpose, appropriate use, and time frame

- Identify the budget components and explain the interrelationships among the components

- Demonstrate an understanding of how the budget is developed

- Compare the benefits and limitations of the budget system

- Evaluate a business situation and recommend an appropriate budget solution

- Prepare budgets on the basis of information presented

- Calculate the impact of incremental changes to budgets

Annual Profit Plan and Supporting Schedules

Planning is essential, and this concept covers the following types of budgets:

Operational Budgets

Financial Budgets

Capital Budgets

You should expect questions around the following:

- Explain the role of the sales budget in the development of an annual profit plan

- Identify the factors that should be considered when preparing a sales forecast

- Identify the components of a sales budget and prepare a sales budget

- Explain the relationship between the sales budget and the production budget

- Identify the role that inventory levels play in the preparation of a production

- budget and define other factors that should be considered when preparing a production budget

- Prepare a production budget

- Demonstrate an understanding of the relationship between the direct materials budget, the direct labor budget, and the production budget

- Explain how inventory levels and procurement policies affect the direct materials budget

- Prepare a direct materials budget and a direct labor budget based on relevant information and evaluate the feasibility of achieving production goals on the basis of these budgets

- Demonstrate an understanding of the relationship between the overhead budget and the production budget

- Separate costs into their fixed and variable components

- Prepare an overhead budget

- Identify the components of a cost of goods sold budget and prepare a cost of goods sold budget

- Demonstrate an understanding of contribution margin per unit and total contribution margin, identify the appropriate use of these concepts, and calculate both unit and total contribution margin

- Identify the components of a selling and administrative expense budget

- Explain how specific components of the selling and administrative expense budget may affect the contribution margin

- Prepare an operational (operating) budget

- Prepare a capital expenditure budget

- Demonstrate an understanding of the relationship between the capital expenditure budget, the cash budget, and the pro forma financial statements

- Define the purposes of a cash budget and describe the relationship between the cash budget and all other budgets

- Demonstrate an understanding of the relationship between credit policies and purchasing (payables) policies and the cash budget

- Prepare a cash budget

Top-Level Planning and Analysis

This section will dive into topics like:

Pro forma income

Financial statement projects

Cash flow projections

You should be prepared to tackle the following:

- Define the purpose of a pro forma income statement, a pro forma balance sheet, and a pro forma statement of cash flows, and demonstrate an understanding of the relationship among these statements and all other budgets

- Prepare pro forma income statements based on several revenue and cost assumptions

- Evaluate whether a company has achieved strategic objectives based on pro forma income statements

- Use financial projections to prepare a pro forma balance sheet and a pro forma statement of cash flows

- Identify the factors required to prepare medium- and long-term cash forecasts

- Use financial projections to determine required outside financing and dividend policy

C. Performance Management – 20%

Topically, this section of the CMA exam will deal with flexible budgets, transfer pricing methods, a balanced scorecard, standard costing, variance analysis and more. Ideally, you’ll practice defining a standard cost system and identify the reasons why that system will work best.

There will be a lot of defining and developing as questions will address your ability to explain the relationships between metrics like KPIs and a strategic financial plan.

Making up 20% of your Part 1 exam, this section covers three main areas:

Cost and Variance Measures

- Analyze performance against operational goals using measures based on revenue, manufacturing costs, nonmanufacturing costs, and profit depending on the type of center or unit being measured

- Explain the reasons for variances within a performance monitoring system

- Prepare a performance analysis by comparing actual results to the master budget, calculate favorable and unfavorable variances from the budget, and provide explanations for variances

- Identify and describe the benefits and limitations of measuring performance by comparing actual results to the master budget

- Analyze a flexible budget based on actual sales (output) volume

- Calculate the sales-volume variance and the sales-price variance

- Calculate the flexible-budget variance by comparing actual results to the flexible budget

- Investigate the flexible-budget variance to determine individual differences between actual and budgeted input prices and input quantities

- Explain how budget variance reporting is utilized in a management-by-exception environment

- Define a standard costing system and identify the reasons for adopting a standard costing system

- Demonstrate an understanding of price (rate) variances and calculate the price variances related to direct material and direct labor inputs

- Demonstrate an understanding of efficiency (usage) variances and calculate the efficiency variances related to direct material and direct labor inputs

- Demonstrate an understanding of spending and efficiency variances as they relate to fixed and variable overhead

- Calculate a sales-mix variance and explain its impact on revenue and contribution margin

- Calculate and explain a mix variance

- Calculate and explain a yield variance

- Demonstrate how price, efficiency, spending, and mix variances can be applied in service companies as well as in manufacturing companies

- Analyze factory overhead variances by calculating variable overhead spending variance, variable overhead efficiency variance, fixed overhead spending variance, and production volume variance

- Analyze variances, identify causes, and recommend corrective actions

Responsibility Centers and Reporting Segments

- Identify and explain the different types of responsibility centers

- Recommend appropriate responsibility centers given a business scenario

- Calculate a contribution margin

- Analyze a contribution margin report and evaluate performance

- Identify segments that organizations evaluate, including product lines, geographical areas, or other meaningful segments

- Explain why the allocation of common costs among segments can be an issue in performance evaluation

- Identify methods for allocating common costs such as stand-alone cost allocation and incremental cost allocation

- Define transfer pricing and identify the objectives of transfer pricing

- Identify the methods for determining transfer prices, and list and explain the advantages and disadvantages of each method

- Calculate transfer prices using variable cost, full cost, market price, negotiated price, and dual-rate pricing

- Explain how transfer pricing is affected by business issues, such as the presence of outside suppliers and the opportunity costs associated with capacity usage

- Describe how special issues such as tariffs, exchange rates, taxes, currency restrictions, expropriation risk, and the availability of materials and skills affect performance evaluation in multinational companies

Performance Measures

- Explain why performance evaluation measures should be directly related to strategic and operational goals and objectives, why timely feedback is critical, and why performance measures should be related to the factors that drive the element being measured (e.g., cost drivers and revenue drivers)

- Explain the issues involved in determining product profitability, business unit profitability, and customer profitability, including cost measurement, cost allocation, investment measurement, and valuation

- Calculate product-line profitability, business unit profitability, and customer profitability

- Evaluate customers and products on the basis of controllable margin and recommend ways to improve profitability and/or drop unprofitable customers and products

- Define and calculate ROI

- Analyze and interpret ROI calculations

- Define and calculate residual income (RI)

- Analyze and interpret RI calculations

- Compare the benefits and limitations of ROI and RI as measures of performance and explain their appropriate usage

- Explain how revenue and expense recognition policies may affect the measurement of income and reduce comparability among business units

- Explain how inventory measurement policies, joint asset sharing, and overall asset measurement policies may affect the measurement of investment and reduce comparability among business units

- Define critical success factors (CSFs) and KPIs and discuss the importance of these measures in evaluating an organization

- Define the concept of a balanced scorecard and identify its components

- Identify and describe the perspectives of a balanced scorecard, including financial, customer, internal process, and learning and growth

- Identify and describe the characteristics of an effective balanced scorecard

- Demonstrate an understanding of a strategy map and the role it plays

- Analyze and interpret a balanced scorecard and evaluate performance based on the analysis

- Recommend performance measures and a periodic reporting methodology given operational goals and actual results

To nail this part, you should understand the ins and outs of actual vs. planned results, how to use flexible budgets to analyze performance, and be able to analyze cost expectations

Additionally, you will need to know the different types of responsibility centers and how to analyze profitability and return on investment using key performance indicators.

D. Cost Management – 15%

Cost management will deal with accounting and operational aspects of business, like costing, overhead, and supply chain. You will need to apply your understanding of how to use different methods to identify portions of mixed costs.

There will be a lot of analysis-oriented questions, including ones on process value, best practice and business reengineering.

The core concepts covered are:

Measurement Concepts

You should feel comfortable performing the following activities:

- Calculate fixed, variable, and mixed costs, and demonstrate an understanding of the behavior of each in the long and short term and how a change in assumptions regarding cost type or relevant range affects these costs

- Identify cost objects and cost pools, and assign costs to appropriate activities

- Demonstrate an understanding of the nature and types of cost drivers and the causal relationship that exists between cost drivers and costs incurred

- Demonstrate an understanding of the various methods for measuring costs and accumulating work-in-process and finished goods inventories

- Identify and define cost measurement techniques, such as actual costing, normal costing, and standard costing; calculate costs using each of these techniques; identify the appropriate use of each technique; and describe the benefits and limitations of each technique

- Demonstrate an understanding of variable (direct) costing and absorption (full) costing and the benefits and limitations of these measurement concepts

- Calculate inventory costs, cost of goods sold, and operating profit using both variable costing and absorption costing

- Demonstrate an understanding of how the use of variable costing or absorption costing affects the value of inventory, cost of goods sold, and operating income

- Prepare summary income statements using variable costing and absorption costing

- Determine the appropriate use of joint product and by-product costing

- Demonstrate an understanding of concepts such as split-off point and separable costs

- Determine the allocation of joint product and by-product costs using the physical measure method, the sales value at split-off method, constant gross profit (gross margin) method, and the net realizable value method, and describe the benefits and limitations of each method

Costing Systems

For job order costing and activity-based costing, the candidate should be able to:

- Define the nature of the system, understand the cost flows of the system, and identify its appropriate use

- Calculate inventory values and cost of goods sold

- Demonstrate an understanding of the proper accounting for normal and abnormal spoilage

- Discuss the strategic value of cost information regarding products and services, pricing, overhead allocations, and other issues

- Identify and describe the benefits and limitations of each cost accumulation system

For specific cost accumulation systems:

- Demonstrate an understanding of process costing and the concept of equivalent units (no calculations required)

- Define the elements of activity-based costing, such as cost pool, cost driver, resource driver, activity driver, and value-added activity

- Calculate product cost using an activity-based system, and compare and analyze the results with costs calculated using a traditional system

- Explain how activity-based costing can be utilized in service companies

- Demonstrate an understanding of the concept of life-cycle costing and the strategic value of including upstream costs, manufacturing costs, and downstream costs

Overhead Costs

To demonstrate your understanding of overhead costs, you should feel comfortable with the following:

- Distinguish between fixed and variable overhead expenses

- Determine the appropriate time frame for classifying both variable and fixed overhead expenses

- Demonstrate an understanding of the different methods of determining overhead rates (e.g., corporate-wide rates, departmental rates, and individual cost driver rates)

- Describe the benefits and limitations of each of the methods used to determine overhead rates

- Identify the components of variable overhead expense

- Determine the appropriate allocation base for variable overhead expenses

- Calculate the per-unit variable overhead expense

- Identify the components of fixed overhead expense

- Identify the appropriate allocation base for fixed overhead expense

- Calculate the fixed overhead application rate

- Describe how fixed overhead can be over- or under-applied and how this difference should be accounted for in the cost of goods sold, work-in-process, and finished goods accounts

- Compare traditional overhead allocation with activity-based overhead allocation

- Calculate overhead expense in an activity-based costing setting

- Identify and describe the benefits derived from activity-based overhead allocation

- Explain why companies allocate the cost of service departments such as human

- resources or information technology to divisions, departments, or activities

- Calculate service or support department cost allocations using the direct method, the reciprocal method, the step-down method, and the dual allocation method

- Demonstrate an understanding of how regression can be used to estimate fixed costs

Supply Chain Management

On the CMA exam part 1, you should be able to:

- Explain supply chain management

- Define lean resource management techniques

- Identify and describe the operational benefits of implementing lean resource management techniques

- Define material requirements planning (MRP)

- Identify and describe the operational benefits of implementing a just-in-time (JIT) system

- Identify and describe the operational benefits of ERP

- Explain the concept of outsourcing and identify the benefits and limitations of choosing this option

- Describe how capacity level affects product costing, capacity management, pricing decisions, and financial statements

- Explain how using practical capacity as the denominator for the fixed cost allocation rate enhances capacity management

- Calculate the financial impact of implementing the above-mentioned methods

Business Process Improvement

- Define value chain analysis

- Identify the steps in value chain analysis

- Explain how value chain analysis is used to better understand a company’s competitive advantage

- Define, identify, and provide examples of a value-added activity and explain how the value-added concept is related to improving performance

- Demonstrate an understanding of process analysis and business process reengineering, and calculate the resulting savings

- Define best practice analysis and discuss how it can be used by an organization to improve performance

- Demonstrate an understanding of benchmarking process performance

- Identify the benefits of benchmarking in creating a competitive advantage

- Explain the relationship between continuous improvement techniques and quality performance

- Explain the concept of continuous improvement and how it relates to implementing ideal standards and quality improvements

- Identify and describe the components of the costs of quality, commonly referred to as prevention costs, appraisal costs, internal failure costs, and external failure costs

- Calculate the financial impact of implementing the above-mentioned processes

E. Internal Controls – 15%

The procedures for internal controls are subject to legislation. This section will require you to know a lot of statutes and regulatory guidelines for things like governance, structures, policies, risk and audits.

Your CMA studies may provide text content or flashcards that help you memorize overarching rules, laws or acts. You will also need to have a firm grasp on how internal controls apply to different kinds of companies (private, public, etc.).

Governance, Risk, and Compliance

This topic covers risk control and policies for safeguarding assurances internally, as well as external audit requirements and corporate governance. Specifically:

- Demonstrate an understanding of internal control risk and the management of internal control risk

- Identify and describe internal control objectives

- Explain how a company’s organizational structure, policies, objectives, and goals, as well as its management philosophy and style, influence the scope and effectiveness of the control environment

- Identify the Board of Directors’ responsibilities with respect to ensuring that the company is operated in the best interest of shareholders

- Identify the hierarchy of corporate governance (i.e., articles of incorporation, bylaws, policies, and procedures)

- Demonstrate an understanding of corporate governance, including rights and responsibilities of the CEO, the CFO, the Board of Directors, the audit committee, managers, and other stakeholders; and the procedures for making corporate decisions

- Describe how internal controls are designed to provide reasonable (but not absolute) assurance regarding the achievement of an entity’s objectives involving (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting, and (iii) compliance with applicable laws and regulations

- Explain why personnel policies and procedures are integral to an efficient control environment

- Define and give examples of the segregation of duties

- Explain why the following four types of functional responsibilities should be performed by different departments or different people within the same function: (i) authority to execute transactions, (ii) recording transactions, (iii) custody of assets involved in the transactions, and (iv) periodic reconciliations of the existing assets to recorded amounts

- Demonstrate an understanding of the importance of independent checks and verification

- Identify examples of safeguarding controls

- Explain how the use of prenumbered forms, as well as specific policies and procedures detailing who is authorized to receive specific documents, is a means of control

- Define inherent risk, control risk, and detection risk

- Define and distinguish between preventive controls and detective controls

- Describe the major internal control provisions of the Sarbanes-Oxley Act

- Identify the role of the Public Company Accounting Oversight Board (PCAOB) in providing guidance on the auditing of internal controls

- Differentiate between a top-down (risk-based) approach and a bottom-up approach to auditing internal controls

- Identify the PCAOB preferred approach to auditing internal controls

- Identify and describe the major internal control provisions of the Foreign Corrupt Practices Act

- Identify and describe the five major components of COSO’s Internal Control-Integrated Framework

- Assess the level of internal control risk within an organization and recommend risk mitigation strategies

- Demonstrate an understanding of external auditor responsibilities, including the types of audit opinions that external auditors issue

- Identify and explain methods for testing the adequacy of internal controls, including inquiry, observation, inspection, and re-performance

- Explain how to remediate internal control deficiencies

Systems Controls and Security Measures

This section covers all sorts of controls, from network to backup controls, as well as business continuity planning. Here’s the full list:

- Describe how the segregation of accounting duties can enhance systems security

- Identify threats to information systems, including input manipulation, program alteration, direct file alteration, data theft, sabotage, viruses, Trojan horses, theft, and phishing

- Demonstrate an understanding of how system development controls are used to enhance the accuracy, validity, safety, security, and adaptability of systems input, processing, output, and storage functions

- Identify procedures to limit access to physical hardware

- Identify means by which management can protect programs and databases from unauthorized use

- Identify input controls, processing controls, and output controls and describe why each of these controls is necessary

- Identify and describe the types of storage controls and demonstrate an understanding of when and why they are used

- Identify and describe the inherent risks of using the internet as compared to data transmissions over secured transmission lines

- Define data encryption and describe why there is a much greater need for data encryption methods when using the internet

- Identify a firewall and its uses

- Demonstrate an understanding of how flowcharts of activities are used to assess controls

- Explain the importance of backing up all program and data files regularly and storing the backups at a secure remote site

- Define business continuity planning

- Define the objective of a disaster recovery plan and identify the components of such a plan, including hot, warm, and cold sites

F. Technology and Analytics – 15%

This section of the CMA exam is the most recent addition. Other areas were reduced to fit it in. It was added to make the exam more relevant to accounting professionals, who use a lot of technology and integrated systems to do their work.

Obviously the exam material can’t get platform-specific, so it deals with high level topics like how to use information systems, how to manage data, and how to automate financial tasks. It’s also important that CMAs understand data analysis, all of which is likely to be collected and reported on in a digital format.

Information Systems

- Identify the role of the accounting information system (AIS) in the value chain

- Demonstrate an understanding of the accounting information system cycles, including revenue to cash, expenditures, production, human resources and payroll, financing, and property, plant, and equipment, as well as the general ledger and reporting system

- Identify and explain the challenges of having separate financial and nonfinancial systems

- Define ERP and identify and explain the advantages and disadvantages of ERP

- Explain how ERP helps overcome the challenges of separate financial and nonfinancial systems, integrating all aspects of an organization’s activities

- Define relational database and demonstrate an understanding of a database management system

- Define data warehouse and data mart

- Define enterprise performance management (EPM) (also known as corporate performance management (CPM) or business performance management (BPM))

- Discuss how EPM can facilitate business planning and performance management

Data Governance

- Define data governance and data management

- Demonstrate a general understanding of data governance frameworks, including COSO’s Internal Control-Integrated Framework

- Identify the stages of the data life cycle, i.e., data capture, data maintenance, data synthesis, data usage, data analytics, data publication, data archival, and data purging

- Demonstrate an understanding of data preprocessing and the steps to convert data for further analysis, including data consolidation, data cleaning (cleansing), data transformation, and data reduction

- Discuss the importance of having a documented record retention (or records management) policy

- Identify and explain controls and tools to detect and thwart cyberattacks, such as penetration and vulnerability testing, biometrics, advanced firewalls, and access controls

Technology-Enabled Finance Transformation

- Define the system development life cycle, including systems analysis, conceptual design, physical design, implementation and conversion, and operations and maintenance

- Explain the role of business process analysis in improving system performance

- Define robotic process automation (RPA) and its benefits

- Evaluate where technologies can improve the efficiency and effectiveness of processing accounting data and information (e.g., artificial intelligence (AI))

- Define cloud computing and describe how it can improve efficiency

- Define software-as-a-service (SaaS) and explain its advantages and disadvantages

- Recognize potential applications of blockchain, distributed ledger, and smart contracts

Data Analytics

Business intelligence

- Define Big Data and explain the volume, velocity, variety, and veracity of Big Data; and describe the opportunities and challenges of leveraging insight from this data

- Explain how structured, semi-structured, and unstructured data is used by a business enterprise

- Describe the progression of data, from data to information to knowledge to insight to action

- Describe the opportunities and challenges of managing data analytics

- Explain why data and data science capability are strategic assets

- Define business intelligence (BI) (i.e., the collection of applications, tools, and best practices that transform data into actionable information in order to make better decisions and optimize performance)

Data mining

- Define data mining

- Describe the challenges of data mining

- Explain why data mining is an iterative process and both an art and a science

- Explain the purpose of Structured Query Language (SQL) and explain its purpose

- Describe how an analyst would mine large data sets to reveal patterns and provide insights

Types of data analytics

- Explain the challenge of fitting an analytics model to the data

- Define the different types of data analytics, including descriptive, diagnostic, predictive, and prescriptive

- Define clustering and classification, and determine when each of these analytic techniques would be the appropriate tool to use

- Demonstrate an understanding of multiple regression and logistic regression and recognize when these techniques are appropriate

- Calculate the result of multiple regression equations as applied to a specific situation

- Demonstrate an understanding of the coefficient of determination (R squared) and the correlation coefficient (R)

- Demonstrate an understanding of time series analyses, including trend, cyclical, seasonal, and irregular patterns

- Identify and explain the benefits and limitations of regression analysis and time series analysis

- Define standard error of the estimate, goodness of fit, and confidence interval

- Explain how to use predictive analytics techniques to draw insights and make recommendations

- Describe exploratory data analysis and how it is used to reveal patterns and discover insights

- Define sensitivity analysis and identify when it would be the appropriate tool to use

- Demonstrate an understanding of the uses of simulation models, including the Monte Carlo technique

- Identify the benefits and limitations of sensitivity analysis and simulation models

- Demonstrate an understanding of what-if (or goal-seeking) analysis

- Identify and explain the limitations of data analytics

Data visualization

- Utilize table and graph design best practices to avoid distortion in the communication of complex information

- Evaluate data visualization options and select the best presentation approach (e.g., histograms, box plots, scatterplots, dot plots, tables, dashboards, bar charts, pie charts, line charts, bubble charts) for a given scenario

- Understand the benefits and limitations of visualization techniques

- Communicate results, conclusions, and recommendations in an impactful manner using effective visualization techniques

CMA Exam Part 1 Format

In addition to knowing what will be on the test, it’s important to know how the test is set up and structured, and what type of CMA exam questions to prepare for.

Currently, the CMA exam pass rate for both parts is just 45%. That should tell you just how hard the CMA is.

Don’t let that stop you, though, just use it to motivate your study efforts. Putting in the time to prepare, using a quality CMA course, and practicing the format as much as you can will give you a huge advantage on exam day.

The CMA exam format contains two standard elements, which are a multiple-choice section and an essay section.

The raw score (how many points you get based on how many right answers) is used to create your final score, which is calculated based on a uniform scoring system. For the CMA, the uniform scoring system runs from 0-500. A passing score is 360.

The exam is entirely computer-based and completed at a Prometric Testing Center, which has locations all over the world.

Here are some more details about the format of each section on CMA Part 1:

1. 100 Multiple Choice Questions

These account for 75% of your exam score. You will be allowed three hours for this section.

Each question on the multiple choice part of the exam is equally weighted. There are no points deducted for wrong answers, only points given for correct answers. With this format, it makes sense to attempt as many MCQs as you can, even when you’re not sure of the answer.

Not every test-taker is getting the same questions or having the same experience. Some versions of the exam may be slightly more difficult than others.

Make sure your review course for CMA Part 1 includes a large and realistic test bank. This will make sure you’ve encountered the full range of difficulty, wording, and question format.

To advance to the essay questions, you need to get at least 50% of the multiple choice questions correct.

2. Two Essay Questions

The essay questions are only accessible if you have passed the multiple choice section by correctly answering at least half of the questions.

Coming in second, you will be presented with two essay questions, both of which you must answer. You will write your answers to essay questions into a very simple word processor on the computer.

Some essays will require you to solve equations or do calculations, which can also be done within the word processor. Many people find it useful to do simulations of this, so they can get familiar with how to use the interface before the day of the test.

This section accounts for 25% of your exam score. You will be allowed one hour to write both of your essays.

CMA Part 1 Study Plan

In order to pass the first part of the CMA exam, you need a plan. Like I said, you want to allocate at least 16 weeks per section of the CMA exam, but this is only the start of the planning you need to do.

Let’s talk about solidifying a study schedule, understanding and practicing for test content and finding the right online course.

Study Time

Over the course of four months, you will want to schedule your CMA study time, just like you would a job or school. Set in advance which days and for how many hours a day you plan to study.

It’s essential that you have a plan like this going in. You’ll be amazed at how many opportunities you have to slack off or procrastinate. Create a study plan and stick to it.

Question Types

Part of your CMA exam studies has to be preparing for the different question types. Many people benefit from using CMA test question banks, flashcards, and CMA textbooks to study. All of these should have extensive detail and give you plenty of opportunity to practice CMA question types.

I recommend using certified management accountant practice tests throughout your studies. Take one at the beginning to find out where you stand. As you progress and learn the content, keep taking practice exams periodically. This will help you track progress and improve your speed for the timed exam.

Online CMA Courses

The best way to put a framework in place is to sign up for a CMA online course. There are several to choose from.

The best CMA study programs include video instruction from experts, CMA practice questions, exam simulators, textbooks, and a variety of study materials. Many people also upgrade to include a CMA coach as this can provide one-on-one assistance that accelerates your progress.

Check out our comparison of CMA review courses to find your best option. CMA Exam Academy’s CMA study materials provide in-depth coverage of each of Part 1’s subjects, ensuring you’re prepared for every exam topic.

For a video walkthrough on how to set up your own CMA study plan, click play below.

CMA Part 1 FAQ

Here are some answers to frequently asked questions about the first part of the CMA exam.

How Many Units Are in CMA Part 1?

There are 100 multiple choice questions and two essay questions in part one of the CMA exam.

What is the CMA Part 1 Exam Test Time?

Part 1 of the CMA exam takes four hours to complete.

How Do I Study For CMA Part 1?

Studying for part 1 of the CMA exam should take about 16 weeks. Most people invest in a CMA study course, which will provide instructor-led sessions, textbooks, practice materials and more.

Do I Have to Pass the Question and Essay Part Simultaneously?

In the CMA exam, you will first tackle 100 multiple-choice questions. Only when you have passed those (50% or more) can you progress to the two essay questions.

Have more questions? Drop them below and I’ll provide answers!

73 Comments on “CMA Exam Part 1: Financial Planning, Performance, and Analytics”

Dear Sir,

I am very interesting to start CMA but I am working. How can I start and guide me on Online, Email and Soft copies are delivery to UAE.

Hi Yusuf,

We’re glad to hear you’re interested in pursuing the CMA!

We ship textbooks worldwide including the UAE. Our 16-Week Accelerator program includes everything you’ll need to study for the exams.

For all the details you’re welcome to click on the following link: 16-week Accelerator Program.

I am intending to appear for CMA Part 1 in 2024 (Q1). I am quite confused about which Study Material (for subject knowledge) to buy and then which question bank (for practice) to follow. I want a Study Text that should have detailed explanations of all areas of subject

either in one book or several.

Hi Saabir,

Our 16-week Accelerator Program per part includes all the study material you will need.

It includes digital textbooks and in paperback, test bank, formula guides, pre-recorded video and audio lectures, coaching support, and weekly coaching calls inside our private group.

To learn more about our 16-week Accelerator program, click on this link to direct you to our website: 16-week Accelerator Program.

Dear Sir,,

How are you,,

I need to know is it important to have an accountant background to pass CMA exam?

I am really interested in it.

Thanks,,

Accounting knowledge is fundamental. Without it, it’s practically impossible to pass the CMA exams. Learn the fundamentals of accounting before attempting at the CMA exam. My program includes a textbook to help professionals like you transition into the accounting field and pass the CMA exam. For all the details you’re welcome to click on the following link: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/ref/nathan/ Reply back if you have any questions. Happy to help. Thanks

Hi Nathan, could you please describe the difference between CMA and CIMA? and which country I can use CMA Certification? is it possible to have only 4 months preparation for Part 1?

Hi Vina,

The CIMA is mostly recognized in the UK and the commonwealth countries. The US CMA, however, is a global designation recognized worldwide. I compare the two certifications in my blog post here.

As for your second question – yes, it is absolutely possible to for one part of the exam in 4 months or less. I actually offer a 16-week study plan per part in my coaching course at the Academy. Check it out here 🙂

If you have any other questions, just hit reply.

Thanks,

Nathan

This Nazik

Iam intersting to get CMA part 1 in Sept 2020 need your advice and from where can I start and need material CMA part1 2020 and exam

Hi Nazik,

The first step is to enroll in CMA review course. If you’d like to study with me, you can enroll in my flagship course here.

If you have any other questions, don’t hesitate to hit Reply 🙂

Thanks,

Nathan

Can I get Your CMA study guide

Hi Safran,

Sure thing. Click here to get your study guide for free.

Hello Sir,

This Sunny here

I am going to attempt this exam in next year of Jan 2020 and I am not getting time due to job.

I want to know that should I am able to clear the exam in first attempt. If I study for a month and than give exam .

I want to clear the exam the exam in first attempt.

So please sir guide me regarding this.

And i am using the willey reference book is it okay for me or not

Hi Sunny,

I recommend studying for at least 4 months (15 hrs/week) before taking the CMA exam for one part.

It’s not an easy exam and to increase your chances of passing on your first attempt you’ll need to devote more time to learning the material and practicing on exam simulations in a test bank.

As for your CMA textbooks, make sure that you have the latest edition that covers the 2020 exam changes. The exam is changing next year so it’s important to study form the most up-to-date materials.

Do you have a test bank, too? It’s a critical study tool as well.

Thank you,

Nathan

Dear Mr

Lathan Liao

Iam working in KSA Ihave master degree in financial accounting

Iwant to obtain CMA certification. but I have no time

How can u pelp me to prepare for the exam

Is it possible to send the overall course via my email

with my best regard

MUZZAMIIL

Hi Muzzamil,

My coaching course and the step-by-step study plan will slash your study time in half. If you’d like to enroll, please click here.

Thanks,

Nathan

Hello Nathan,

In today’s competitive world just doing a course won’t get you a job unless you have experience. After doing CMA what about experience?

Regards,

Deepti

Hi Deepti,

In order to obtain the CMA certification, candidates are also required to submit the experience requirement to the IMA. Click here to read more about it.

You can fulfill the experience requirement either prior to, or within 7 years of passing the CMA exam.

For candidates who passed both parts but don’t have much or any work experience yet, informing the employer about the passed exam gives them a competitive edge over their peers, as it confirms that they’ve mastered the CMA material and are knowledgeable enough to take on a management accounting role.

Here’s another blog post on how to promote your CMA designation.

Let me know if this answers your question, Deepti, and also if you have any others 🙂

Thanks,

Nathan

Hello Nathan,

The link is not working. Could you please help?

Regards,

Deepti

Hi Deepti,

I’m sorry about that! Could you please try accessing the links again?

Thank you,

Nathan

Sir I want to know that it is very hard to crack CMA exam. I wanted to apply for this exam. Please tell me in which institute I must prefer for CMA entrance exam.

Hi Anand,

The exam is definitely not easy. To compare the best courses available and to assess which one is the best for you, please check out my Best CMA Review Course comparison chart. Thanks, Nathan

I am interested in the knowledge and its application rather than the exam itself. How can you help?

Hi Diaa,

Since you’re only interested in the knowledge and its application, my suggestion is to purchase textbooks and a test bank to learn the material. The textbooks will provide you with the knowledge, and the test bank will help you apply that knowledge in various scenarios and test your level of comprehension.

Hi, I am Prakhar

how much time on a average it takes to clear CMA.

Thanks

Hi Prakhar,

It takes around 200 hours of studying to prepare for one part of the exam.

Click here to learn more about the CMA certification and how to obtain it.

Let me know if you have any other questions 🙂

i want to study cma

Hi Suliman,

I can help you prepare for the CMA exam via my coaching course, check it here.

Let me know if you have any other questions.

I have been studying CMA for a couple months, but the materials from the Wiley CMA doesn’t really helpful, because it does not contain specific details. Can anyone suggest me the other materials to study?

Hi Kate,

I suggest you to supplement your current study materials with this coaching course. It includes in-depth video lectures on all topics tested on the CMA exam and unlimited 1-on-1 coaching so you can ask as many questions as you need to fully understand the material.

sir i have done mba in finance and has experience in differnt field . i want to do cma. please advise

You are eligible for the exam, however to become certified you’ll need to fulfill the experience requirement within 7 years of passing the CMA exam.

For more information, check the CMA roadmap here.

I am a b.com graduate..am planning to take up CMA course as my career.I am an average student..not that much sharp in accounting and finance field..do you feel it as a right move..?in which all fields should I be more careful regarding taking up CMA?reply me asap.

Hi Rijas,

The process of preparing for the exam will help you sharpen your skills in management accounting, so you don’t need to worry about that, especially if you choose to study with a coach who will be by your side throughout your journey to answer all the questions you have and help you grasp the material faster and easier.

For more information, check the roadmap to becoming a CMA here.

Best wishes!

Hi Nathan,

Im Vignesh Ravi, an IT graduate. Due to some issues I couldnt take up Commerce as my High-School Major but now I want to move to the Finance & Accounting field and I was adviced to take up CMA. Do you its a right move to make by taking up CMA exam now. If not, can you suggest any possible carrier that could take me to the Finance stream.

Looking forward to you speedy reply.

Hi Vignesh,

If you have a bachelor’s degree in any area, then the CMA will be the fastest track to get you into accounting and even position you to obtain a management accounting job in the future. You can learn more here.

I’m happy to answer any further questions you may have.

i am Abdiwahab

,

I am really interested to do the CMA .I am already having B.com . Since last 4 years i’m working as an accountant in a contracting company. really confused on this. but i would like to starta professional qualification. please advice me which one to start?

Hi Abdiwahab. If management positions are appealing to you, then go for the CMA, you won’t regret it. Wish you best of luck in your journey and if you need any help, don’t hesitate to reach out!

Hi

Will there be any questions in CMA Part 1 regarding significant differences between IFRS & U.S. GAAP.

Hi Tanya,

Based on IMA’s LOS, there’s always chance that the question you mentioned will be tested but to a very limited extent.

Thanks,

Nathan

Hi sir ,

I am really interested to do the CMA .I am already having M.com . Since 8 years i’m working as an accountant in a contracting company … is CMA is only related to cost accounting?? really confused on this. but i would like to get a professional qualification also.

Hi Sherin,

To know about the CMA certification, please check the CMA Roadmap link here.

Thanks,

Nathan

Dear Nathan,

I’m a finance guy with 4 years of experience in a Treasury Dept. I’m actually debating between CMA or CTP.

So my question is, what should I go for and why?

Hi Haitham,

If you are planning to specifically target Treasury as a long-term career, then, I would suggest pursuing CTP. But if you would like to expand your competitive reach in the corporate world, it would be best to take the CMA. Treasury is only one aspect of management accounting. Management accounting covers a lot of disciplines from accounting to economics to corporate finance. The CMA exam is a broader than CTP. It covers financial planning, analysis and decision-making (recently, the CMA expanded on external financial reporting). Regardless of what you choose, an investment in knowledge pays the best interest. Keep learning and improving, Haitham!

Cheers,

Nathan

Hi Rajesh Here,

When can I complete the exam if I purchase the course in this month?

Thanks in advance

Regards,

Rajesh

Hi Rajesh,

If you purchase the course this month, we can advise you to take the exam either on the last week of February or more preferably, in May.

Thanks and Regards,

Nathan

Hi sir ,

First of all thank you for give good clarification about to CMA what exactly I needed.I am really interested to do the CMA .I am already having M.com . currently I am not working and house wife too …so I didn’t have working experience too ….is working experience required for doing CMA?

Hi Sherinaz,

The two-year working experience requirement can be fulfilled prior to or within seven years after passing the exam. You can take the CMA exam and attain the “CMA Passer” status until you complied with the CMA experience requirement.

Thanks and Regards,

Nathan

Hi Nathan,

Let me first congratulate you for the work you are doing,It is highly appreciable.Your help made me boost my confidence to do CMA.

As you know CMA is uncommon as compared to CPA,so I always get confused to which course to do.

Also just like you I have a full time job with household work,and I find very difficult to take out some time to study,So can you please help me as to how to approach to CMA.

Also what % we need to pass each part(MCQ and Essay Individually)

I am planning to part 1 first because it is comparatively difficult and I like to chase for that first.

Hi Trupti,

Please check our CMA Courses using this link.

MCQ is 75% and Essay is 25% of your final score. You have to get 50% (or at least 50 correct MCQ items) of the 100 item MCQs in order to get to the essay portion. But that 50% should have a scaled score of at least 235 and have a perfect essay equivalent score of 125 to get a total of 360. The best way is to have at least 282 (75% x 375) scaled from your multiple choice questions or more and a decent score from your essay of 78-94 (62% to 75% of 125) to pass the exam.

Thanks,

Nathan

Dear Nathan,

I have appeared twice for part 1 and failed to succeed both the times. Can you recommend any possible solution so that I can complete my certification since my membership is expiring by the end of December-2016. Kindly suggest any study material in particular so that I can focus better.

Thanks,

Regards,

Lucas

Hi Lucas,

We can help you through our CMA courses. Please check this link.

Thanks,

Nathan

hi, can you please let me know whether we can use same 2015 study materials for coming years CMA preparation.

Hi Ancy,

Yes, Ancy. The 2015 study materials can still be used for the coming years as there is no announced curriculum change from IMA yet.

Thanks,

Nathan

Hello Mr. Nathan,

I am really interested to do the CMA. I am already having MBA finance. Currently I am working in Saudi Arabia. Could you please brief what should I do for getting the CMA.

Hi Renjeev,

You may check my blog post about how to become a CMA using this link.

Thanks,

Nathan

thank you for your efforts

You’re welcome Badawy!

Nathan

Hi Nathan,

I want know is this totally correspondence course and how many parts are there to complete a CMA.

Thank you,

Ibrar

Hi Ibrar,

The complete Part 1 syllabus is listed here. There’s also part 2 though.

I have taken CPA exams several times and have failed by couple of points, I’m at the point of giving up it’s been on and off trying to pass, I was wondering if maybe I should be getting my CMA instead and if it is an easier exam than the CPA?

Hi Maryelin,

It depends on what you are interested in doing long-term. I wrote an article comparing both designations. If you have any questions after reading it, let me know.

GOOD

please note that cma exam isn’t available in my country sudan cause of sanction program so if I ready to take it will cost me a lot, your advice is much more important 😮

alsalm 3lykom.

hello dear

I hold an MBA degree in finance and banking specialization and I want to attain CMA please advice me and provide an appropriate strategy to start.

thank you:)

I need to start, I am Egyptian guy and living in KSA, let me know how to start if you find time to help.

Thanks for your help in this

Hi this ayeda

I want to know if aim going to purchase the CMA study guide and coach when it’s the possibility to be deliver as my exam after 1 month part one and aim from UAE

thanks really and appreciated your achievements

Regards

Ayeda

Ayeda,

My study guide is delivered via email so you’ll get it within a few minutes after purchasing it 🙂

really I want to pass the exam and know more of accounting

Study diligently, memorize formulas, and take mock exams until you are scoring at least 80%. Best of luck!

Dear ,

I went 2 time for the CMA part 1 exam and did not pass , It the only part for me to get my cma I have chance till June 2014 , otherwise I had to take the 2 part . It seem my problem is the easy question . as I finish the MSQs and the essay opened for me .

I am planing to go in Janurary 2014 .

I really appreciate your support to help me pass this time

Hi Hindoia,

You are very close to achieving your CMA credential!! If your weakness area is the essay section, take a moment to read my latest blog post. I wrote all about the essay section of the exam. Let me know if you have any questions after reading it. I’m here to help 🙂