How to Become a CMA: Everything You Need to Know About

Back to Frequently Asked Questions

Making the choice to become a Certified Management Accountant is exciting. Career advancement opportunities and increased career versatility are the top reasons people pursue this certification. But understanding all the certification requirements and figuring out how to become a CMA can be overwhelming.

Below, I have broken down the key information you will need in order to earn your designation in Certified Management Accounting.

Unlike other certification programs, the CMA program lets you proceed at your own pace. You can earn a CMA certification in as little as eight months, or stretch your CMA exam prep up to 3 years. Busy financial professionals will find the CMA program to be time-efficient.

Originally published in 2012, this article was updated and republished on March 4, 2024.

6 Steps to Become a CMA

- Become a Member of the IMA

- Fulfill the Education Requirement

- Fulfill the Work Experience Requirement

- Join the CMA program

- Pay the CMA Exam Fee and Book an Exam Date

- Pass the CMA Exam Part 1 and Part 2

Become a Member of the IMA®

Becoming an IMA member is simple. Here are the membership options available to you:

IMA Professional Members

The Professional membership fee is $295 annually. This membership is for individuals who already have or aspire to a career in accounting or finance.

With a professional membership you can take advantage of the IMA’s cutting-edge resources to further expand and hone your knowledge and skills in all areas of management accounting (strong analytical skills, management skills, communication skills, mentoring skills).

IMA Student Members

If you are a current student at an accredited college or university, then you are eligible for the Student membership.

Students have the option of choosing a One- or Two-Year membership. The fee is $49 per year (or $98 for the two-year option). Student members have access to many of the benefits of regular Professional members but at a significantly discounted price.

IMA Academic Members

If you are a full-time faculty member of an accredited institution, you can get the Academic membership for $160 annually.

Unlike other membership options, Academic members get access to the IMA’s ethics curriculum, webinars, case studies, mentor program, research grants, and various other teaching resources.

Staff Enrollment Discount Program

If your organization signs up 5 or more staff members, you will receive a 20% discount on your membership rate, or $225 per member.

Members who are enrolled in the Staff Enrollment Discount Program have full access to all IMA amenities, including CMA certification, continuing education, networking and more.

This discount is run under one company organizer name and paid as a lump sum each year. When adding new members to the program, certification fees are calculated on a pro rata basis.

If a new employee has already paid their IMA membership for the year, no refund will be provided for unexpired months remaining in their current membership.

For full details on exam eligibility requirements and pricing of each IMA membership, check out IMAnet.org.

Fulfill the CMA Education Requirements

Candidates must earn a bachelor’s degree from an accredited university or college. You may also choose to earn a professional certification in order to qualify.

Most often, CMA candidates earn degrees in accounting, finance, economics, and general business. However, as long as your degree is from an accredited school, you can pursue this accounting certification without a degree in accounting or finance.

You must fulfill the education requirement either prior to taking the CMA exam or within 7 years of passing the two-part exam.

Learn more in our in-depth article on the CMA education requirements.

Fulfill the CMA Work Experience Requirements

CMA candidates are required to complete 2 consecutive years of full-time professional experience.

You must fulfill the experience requirement either prior to taking the CMA exam or within 7 years of passing the CMA exam.

The time flexibility of this requirement allows all candidates the opportunity to either study for the exam or earn their professional experience first. I encourage taking the CMA exam even if you don’t have relevant work experience yet. Why? Because the CMA will open doors for you faster than not having it.

Regardless of how you choose to fulfill the experience requirement, you will need two years of experience in management accounting and/or financial management. This means having a professional, full-time position. The CMA certification is often pursued by professionals who already have a career in accounting or finance – such as business accountants or financial managers.

If you are unable to work full-time, you can work part-time at 20 hours per week for 4 consecutive years in the same field.

If you are an academic and 60% or more of your courses are accounting and corporate financial management courses above the fundamental level, you also meet the experience qualifications.

Qualifying experience may include working as a staff accountant to a CFO in roles such as financial analyst, senior corporate accountant, etc. To find out if your role qualifies, check out this guide to the CMA work experience requirements.

Join the CMA Program

Once you’re an IMA member, you can become a CMA candidate by entering the CMA program.

The CMA Program Entrance fee depends on your IMA membership:

- Professional members: $300

- Student and Academic members: $225

This is a one-time, non-refundable fee that must be paid before taking the certification exam.

It expires within 3 years of entering the CMA program, and if both exam parts are not completed and passed within this timeframe, any passed part will expire and the CMA entrance fee will have to be repaid.

The CMA Entrance fee includes credential review for educational and experience qualification, 6 months access to CMA Exam Support package, final score report, performance feedback reports for those who do not pass, personalised certificate for office display, and congratulatory notifications to employer or others.

Pay the CMA Exam Fee and Book an Exam Date

Now that you’ve joined the CMA program, you will need to decide your exam day and pay for the exam fee.

CMA Examination Fees

In order to be able to book your exam date, you’ll need to pay the exam fee first, which is $495 per part.

But if you have the Student or Academic membership, you’ll only need to pay $370 per part.

CMA Exam Windows

Exams are offered according to the following schedule:

- January and February

- May and June

- September and October

To schedule exam appointments, visit www.prometric.com/ICMA. Registrations close after the 15th of February, June, and October.

There is no fee to reschedule your exam IF you do so 31 days or more before your scheduled exam date. If there are 30 days or less remaining until your scheduled exam date, it will cost you $50 to reschedule.

Note that you can only reschedule within the same exam window, and you cannot push your exam date to another exam window or cancel it altogether.

For more information, read the CMA Handbook.

CMA Exam Locations

Exams are administered through the worldwide network of Prometric Testing Centers and are available in accordance with local customs.

There are many locations throughout the U.S. and internationally. To locate a Testing Center and schedule exam appointments, visit www.prometric.com/ICMA.

CMA Exam Retake Policy

An exam part may be taken only once in a testing window. All exam retakes require a new registration along with payment of appropriate fees.

ICMA’s Relationship with the IMA

The ICMA is the examining body for the CMA exam and they do not share any insider tips or secrets with the IMA. They are a completely independent entity responsible for impartial grading of all CMA exams.

The IMA is an administrative association that manages memberships and provides support to those individuals.

- Developing, administering, and grading the CMA exam

- Establishing policies and procedures for the CMA exam

- Ensuring the overall integrity of the CMA exam

Pass the CMA Exam Part 1 and Part 2

A full breakdown of the Content Specification Outlines for both CMA exam Part 1 and 2 can be found below, but what’s not mentioned is how crucial it is to use a CMA exam review course to prepare you for success.

There are plenty of CMA study guides and review courses to choose from, but not all courses are designed the same.

CMA courses that come with the following resources will guarantee your exam success:

Personalized Expert CMA Coaching

One-on-one coaching gives you unparalleled insight into the CMA exam, and the chance to work directly with someone who has taken the exam. An experienced CMA understands what study material is most important and can answer your most pressing questions. Most candidates get stuck when the study material gets difficult. Having a CMA Coach to turn to is crucial to exam success.

Accountability Check-Ins and Assignment Tracking

Maintaining a study schedule can be difficult, so it’s incredibly helpful to have an accountability partner to report to. An accountability partner can motivate you to stay focused when you feel overwhelmed or tempted to procrastinate.

Textbooks and Test Banks

Textbooks are a staple of any good CMA review course. Not all textbooks are created equal though. Some are filled with jargon and fluff that confuse candidates. This was the biggest reason why my CMA review textbooks were written in plain English and are super easy to understand.

CMA test banks contain thousands of practice questions (multiple choice questions, essay questions, calculation questions) that give you valuable insight into the exam format, and question structure. They will also help you discover which material you excel at, and areas where you need more work.

Video Lectures and Audio Reviews

Video lectures are a fun and interactive learning tool that can help you understand core topics better.

The advantage of video lectures is that you can see formulas and examples explained on the screen, which may help you retain the material better.

Audio reviews, on the other hand, are perfect for candidates that are trying to study on the go. Great for your commute to work or running errands, audio material can help you brush up on key concepts while multitasking.

Exam Formula Guides

The CMA exam has many key formulas, and you are required to know them all. Choosing the wrong formula could cause you to fail the exam.

Needless to say, having the formula guides for reference is essential.

Breakdown of the CMA Exam Syllabus

The CMA exam is made up of Part 1 and Part 2, both of which cover different material. Below is a full breakdown of what you can expect in each part of this computer-based exam.

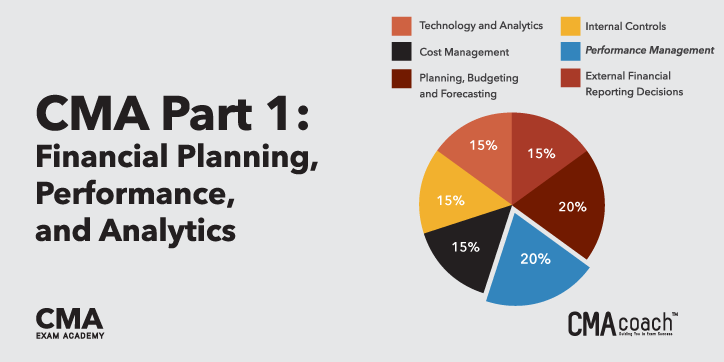

CMA Part 1: Financial Planning, Performance, and Analytics

The percentages show the relative weight range given to each section in the exam.

A. External Financial Reporting Decisions – 15%

Financial Statements, and Recognition, Measurement, Valuation, and Disclosure.

In terms of Financial Statements, you should be comfortable with:

- Balance Sheets

- Income Statements

- Statement of Changes in Equity

- Statement of Cash Flows

- Consolidated Financial Statements Prepared Under U.S. GAAP

- Integrated Reporting

For Recognition, Measurement, and Valuation, you need to understand:

- Asset Valuation

- Valuation of Liabilities

- Income Taxes

- Leases

- Equity Transactions

- Revenue Recognition

- Income Measurement

- Significant differences between U.S. GAAP and IFRS

B. Planning, Budgeting and Forecasting – 20%

There are 6 core topics covered in this section, including strategic planning, budgeting concepts, forecasting techniques, budgeting methodologies, annual profit plan and supporting schedules, and top level planning and analysis.

1. Strategic Planning

Understand what goes into strategic planning, such as identifying long term goals and aligning tactics to achieve those goals, as well as planning models and analytics techniques

2. Budgeting Concepts

This topic includes resource allocation, understanding performance goals, and the ability to characterize a successful budgeting process.

3. Forecasting Techniques

Get up to date on your regression analysis and learning curve analysis to tackle this section.

4. Budgeting Methodologies

Make sure you understand the different ways to budget, such as the difference between zero-based budgeting, project budgeting, flexible, and activity-based budgeting.

5. Annual Profit Plan and Supporting Schedules

This section will cover topics like operational budgets, as well as financial and capital budgets that you can use to create annual profit plans.

6. Top-level Planning and Analysis

Understand cash flow projections, pro forma income, and financial statement projects.

C. Performance Management – 20%

Performance Management covers three main areas:

- Cost and variance measures

- Responsibility centers and reporting segments

- Performance measures

You will need to understand the ins and outs of actual vs. planned results, how to use flexible budgets to analyze performance, and be able to analyze cost expectations

Additionally, you must be able to differentiate between the different types of responsibility centers and how to analyze profitability well as return on investment using key performance indicators.

D. Cost Management – 15%

You must be able to complete calculations related to various costing methodologies.

The core concepts covered are broken down in 5 subsections below:

- Measurement Concepts – Cost behavior, concepts, and terminology

- Costing Systems – Various systems for costing just as job order, process or life-cycle costing

- Overhead Costs – Fixed and variable overhead expenses and determination of allocation base

- Supply Chain Management – Blend of management techniques as well as planning and analysis

- Business Process Improvement – Analysis that leads to continuous improvement concepts to create more efficient accounting processes

E. Internal Controls – 15%

The concepts covered in this section are mostly conceptual, which makes it difficult for many candidates. The core components you should grasp are as follows:

- Governance, Risk, and Compliance – Including risk control and policies for safeguarding assurances internally, as well as external audit requirements and corporate governance.

- Systems Controls and Security Measures – Controls from network to backup controls, as well as business continuity planning.

F. Technology and Analytics – 15%

The final CSO of CMA Part 1 covers information systems, data governance, technology-enabled finance transformation, and data analytics.

The focus is on analytics and how accounting technology ties into it. You should feel comfortable with accounting information systems, data policies and procedures, process automation and applications, and business intelligence.

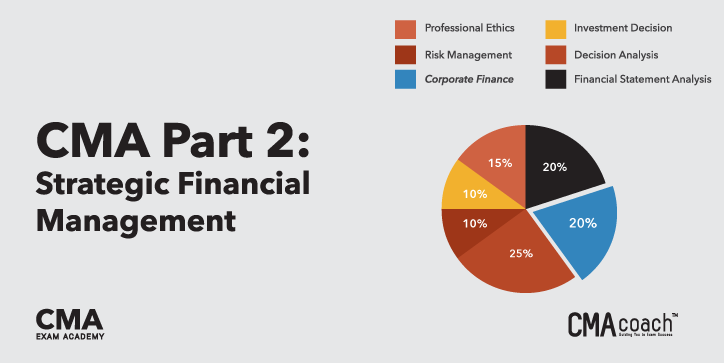

CMA Part 2: Strategic Financial Management

The percentages show the relative weight range given to each section in the exam.

A. Financial Statement Analysis – 20%

There is a lot of material to cover in this section, and your financial analysis abilities need to extend further than standard operating procedures. Here is a full breakdown of all the topics you need to understand:

- Comparative Financial Statement Analysis

- Common-size financial statements

- Common base year financial statements

- Financial Ratios

- Liquidity

- Leverage

- Activity

- Profitability

- General

- Profitability Analysis

- Income measure analysis

- Revenue analysis

- Cost of sales analysis

- Expense analysis

- Variation analysis

- Special Issues

- Impact of foreign operations

- Effects of changing prices and inflation

- Impact of changes in accounting treatment

- Accounting and economic concepts of value and income

- Earnings equality

B. Corporate Finance – 20%

Another big section here. Below are the core topics and their subtopics that you will need to master:

- Financial Risk and Return

- Calculation return

- Types of risk

- Relationship between risk and return

- Long-term Financial Management

- Term structure of interest rates

- Types of financial instruments

- Cost of capital

- Valuation of financial instruments

- Raising Capital

- Financial markets and regulations

- Market efficiency

- Financial institutions

- Initial and secondary public offerings

- Dividend policy and share repurchases

- Lease financing

- Working Capital Management

- Working capital terminology

- Cash

- Marketable securities

- Accounts receivable

- Inventory

- Short term credit and working capital cost management

- General

- Corporate Restructuring

- Mergers and acquisitions

- Other forms of restructuring

- International Finance

- Fixed, flexible and floating exchange rates

- Managing transaction exposure

- Financing international trade

C. Business Decision Analysis – 25%

Lots of calculations in this section, so get familiar with your core formulas. This section tackles:

- Cost/Volume/Profit Analysis

- Break-even analysis

- Profit performance and alternative operating levels

- Analysis of multiple products

- Marginal Analysis

- Sunk costs, opportunity costs, and other related concepts

- Marginal costs and marginal revenue

- Special orders and pricing

- Make vs. buy

- Sell or process further

- Add or drop a segment

- Capacity considerations

- Pricing

- Pricing methodologies

- Target costing

- Elasticity of demand

- Product life-cycle considerations

- Market structure considerations

D. Enterprise Risk Management – 10%

A relatively small portion of your exam mark, this section requires your understanding of the different types of risk and how to assess them. You are expected to know how to mitigate and manage the level of risk, specifically:

- Enterprise Risk

- Types of risk

- Risk identification and assessment

- Risk mitigation strategies

- Managing risk

E. Capital Investment Decisions – 10%

Investment decisions require you to understand the capital budgeting process and capital investment analysis methods.

If you understand incremental cash flows, tax considerations, rate of return, and payback, then you should be good. Here’s the topic breakdown:

- Capital Budgeting Process

- Stages of capital budgeting

- Incremental cash flows

- Income tax considerations

- Evaluating uncertainty

- Capital Investment Analysis Methods

- Net present values

- Internal rate of return

- Payback

- Comparison of investment analysis methods

F. Professional Ethics – 15%

Finally, ethics makes up the final CSO of CMA Part 2.

You will need to understand all levels of ethics, from basic business ethics to ethical considerations for organizations and accounting professionals.

This includes knowing:

- Business Ethics

- Moral philosophies and values

- Ethical Decision making

- Ethical Considerations for Management Accounting and Financial Management Professionals

- IMA’s Statement of Ethical Professional Practice

- Fraud triangle

- Evaluation and resolution of ethical issues

- Ethical Considerations for an Organization

- Organizational factors and ethical culture

- IMA’s Statement on Management Accounting, “Values and Ethics: From Inception to Practice”

- Ethical leadership

- Legal compliance

- Responsibility for ethical conduct

- Sustainability and social responsibility

For a fully inclusive, well-rounded review course, learn more about how the CMA Exam Academy can help you pass on the first try.

Until next time!

273 Comments on “Everything You Need to Know About How to Become a CMA”

hi.

is there a regulating body for CMA course agencies?

i want to file a complaint against CMA Philippines for a fraud!

i took the course and submitted my case paper then they advised me to take 2 conversion courses when i finished already the requirements.

Hi Kath,

I would encourage you to reach out to the IMA as they might investigate your case further. You can contact them via their official website or you can email them at [email protected].

Hi. I’m from the Philippines. I am a graduate in BS Accountancy. Am I qualified to take the CMA exam? I’ve been working as accounting assistant for two years also.

Hi Zyrelle,

Your bachelor’s degree in Accountancy qualifies you to take the CMA exam. The CMA does not require a specific background in accounting, although knowledge in accounting and finance is fundamental for the exam content. Many candidates from diverse academic backgrounds successfully earn their CMA certification.

Hi again, sir Nathan! Thank you for answering my previous question.

I would like to ask another question, I am planning to take one part of CMA examination next year either September or October testing window, but I will only earn my degree around June (my graduation). Can I still be able to avail the student fee if I will process my examination as early as now but I will take my examination in October which is after my graduation?

Hi! I am planning to take one part of the CMA examination in the Philippines, but after that I am planning to go to New Zealand, is it possible to take the other part in the other country? Thank you!

Hi Ac,

Thank you for your question.

Absolutely, you can take different parts of the CMA examination in different countries. The CMA exam is offered globally at Prometric testing centers.

Hi , I am having graduate degree in Bachelors in Commerce and and also having professional experience of Ten years. However, I now have enrolled with a University for Masters in Commerce(Professional Accounting and Finance) a online degree Programme which provides 30 semester Hours per semester. Please help me to know if i am eligible to apply for IMA student Membership or not.

Hi Prasad,

To qualify for the IMA Student membership, you must be enrolled in 6 or more credit hours at an accredited college or university.

A partial listing of accredited international and US institutions is available at http://univ.cc/world.php.

For more information about membership options, the best course of action is to contact IMA directly via http://www.imanet.org.

Thank you,

Nathan

Good day sir! I just wanna ask if those who graduated in Bachelor of Science in Management major in Business Management can take the CMA? Thank you

Hi Yanna,

The CMA certification requires you to have a bachelor’s degree that comes from a regionally accredited or Distancing Education Accrediting Commission (DEAC) accredited university or college.

You can check a partial listing of accredited international and US institutions is available at http://univ.cc/world.php.

If you have any follow-up questions, please don’t hesitate to reply.

Hi Yanna,

The CMA certification requires you to have a bachelor’s degree that comes from a regionally accredited or Distancing Education Accrediting Commission (DEAC) accredited university or college.

You can check a partial listing of accredited international and US institutions is available at http://univ.cc/world.php.

If you have any follow-up questions, please don’t hesitate to reply.

Hi- After passing exams and getting the CMA certificate ; do we have to pay the IMA membership fee every year in order to keep CMA or is it a one time cost and you hold it forever like an MBA title ??

Hi Sergen,

After you have become certified, you’ll have to pay the appropriate membership fee every year to remain an active CMA.

Nathan

I have met all of the requirements except the experience in progress. Do I need to wait to complete my experience to be referred to as a CMA?

Yes, you’ll get the CMA title after your complete all the requirements, including the work experience requirement.

Hi Nathan!

I am a post graduate of Business course, BS Management ( Accounting Subject 1 to 3 and Finance 1 and 2 was included in our curriculum) and i had 12 years of work experience handling Accounting and Financial task in my previous employment. am qualified to take CMA certification? Thank you.

Hi Nikki,

I believe you do meet both the education and work experience requirement for the CMA certification. But I’d recommend double-checking with the IMA for they have the last say in that 🙂

Thanks,

Nathan

Hi Nathan,

In your opinion for someone that has a bachelor’ degree in Economics and a minor in business + 7 years of multi-department work experience in management of a food manufacturing company, is using a CMA review course as an “educational tool” enough to gather all the knowledge needed to pass the CMA exam?

I know taking the CMA test just requires a Bachelor’s degree in any field, but do review courses educate a person enough to pass the test or should people really look into getting a 2nd bachelor’s, grad certificate, or a masters degree even to make sure they are properly educated in all accounting principles first?

Hi Jason,

I’d say it depends on the review course.

The material in some of the review courses is laced with jargon which may make it harder for candidates with no extensive accounting background understand it.

At the Academy, I’ve designed a study program that can help candidates at all accounting levels successfully prepare for and pass the exam. Check it out here.

Thanks,

Nathan

helo sir nathan! i am planning to take cma exam in the philippines, is it posssible that i can get a job in the US after passing? thank youu!

Hi there,

Yes, the CMA certification will give you a competitive edge over your peers when applying for jobs in the US. CMAs are in very high demand.

If you have any other questions, please don’t hesitate to hit reply.

Thanks,

Nathan

Presently i am working with a manufacturing industry, and i would like to do the CMA course. I have one doubt regarding course eligibility- i am done my PG(MBA-Fin) through distance education.

Can i eligible to do the course.

I believe you meet the education requirement for the CMA certification, but just to be sure, please reach out directly to IMA.

I missed the foundation examination of june term because my 2nd year final exams.

Could I give it in december term?

What will be the charge for giving the exam in the december term?

Vishal, Are you referring to a different CMA designation? The CMA-US designation doesn’t include a foundation examination nor a December exam window.

Hi, I want to know which is the official site to register for CMA exam. Thanks

Hi Trinh, to obtain your membership and apply for the CMA certification, the official site is http://www.imanet.org. Thanks, Nathan

Hello,

I had attended and passed both CMA Part 1 and CMA Part 2 examination during the months June and October, 2016 respectively. During the period i made a payment to IMA too.

But now, my membership is seen as expired. What can i do in this regard?

Follow up question to the above,

No Outstanding invoices are shown. The only message shown is that Membership has expired.

Hi Farha, please contact the IMA directly to renew your membership. They’ll be able to provide you with an invoice to renew it. Thank you, Nathan

Hello,

I had attended and passed both CMA Part 1 and CMA Part 2 examination during the months June and October, 2016 respectively. During the period i made a payment to IMA too.

But now, my membership is seen as expired. What can i do in this regard?

Hi Farha,

Your IMA membership needs to be renewed every year. To renew it, login to your IMA account and pay your outstanding invoice. Thanks, Nathan

I just passed my 12th n m thinking to do CMA, is that field helpful in abroad?

Yes, the CMA is a global certification so it’s recognized in most countries of the world. Where would you like to build your career?

I am a CA FINAL student. Can i apply for CMA FINAL directly? Or i have to appear for foundation also?

Aditi, looks like you’re studying for the Indian CMA exam. Unfortunately, I can’t help you with your questions as I’m offering coaching support only for the US CMA exam.

hi nathan my self tarun from india i was working as a banker and i want to complete cma and shift to abroad ,i was graduate having 6 years of experience in banking,can you kindly tell me how can i move further to complete cma ,do i get job abroad after completing cma

Hi Tarun,

Holding the CMA certification will certainly increase your chances of finding a better job in any country. For more info on all the steps you need to take to become certified, please check here the roadmap to becoming a CMA.

If you have any further questions, please don’t hesitate to reply back to this comment.

Hi Nathan,

My wife has a bachelor degree from Egypt in Science and Education (4 years).

She wanted to get into CMA despite the fact she doesnt have any accounting background.

As you may be ware of the fact that The president of IMA was a Math teacher so he didnt have any accounting background. I have checked on IMA website for the requirement needed to enrol but its still not clear. I understand that she need to have 2 years experience within finance/accounting role. I’d appreciate it if you can provide me with some insight for a bachelor of non business background

Hi Tarek,

A bachelor’s degree in any field will meet the education requirement.

The experience requirement can be fulfilled either prior to or within 7 years of passing the exam.

Normally, candidates who pass the CMA exam are able to get a job in the management accounting field even if they don’t have an accounting degree.

If you have any other questions, let me know!

Hi Nathan,

I have just 1 year remaining from my 3 years. and I failed twice in first part. but I will re exam again through next window.

But i’m afraid that if I will pass the first part, may be I couldn’t catch to pass second part within only the next 10 months.

what can I do for this problem?

can repay the entrance fees again especially I didn’t pass any part?

Hi Karim,

I recommend you to reach out directly to IMA and see if they can extend your program by another year to give you more time to complete both parts.

If you need additional help with your studies to increase your chances of passing the exam, please consider enrolling in a coaching course like this one.

Best of luck!

Hi,

I don’t have credit card, is it possible to make payment of exam fee by debit card ?

Yes, you can pay the fees with a debit card too!

Hey nathan,

What are the procedures for changing membership from student to professional .. Can we do it ?? Will it effect the exams passed?

Hey Verghese,

You’ll need to reach out to the IMA to change your membership level. It will not affect your exam scores.

Hello Nathan,

I have a Bachelors in Commerce degree. And no work experience. I completed my B.com last year. Can i do CMA now? I would like to do it as early as possible. Can i take finish both exams within 6 months after getting my membership? And what happens if i pass one group and fail in another? Do i have to re write both groups or the one i failed?

Hi Danish,

Yes, you can sit for the exams now and fulfill the experience requirement within 7 years of passing the exam.

If you opt for a coaching course instead of self-studying, and thus reduce the amount of time needed to prepare for the exam, you can absolutely pass both exams within 6 months after getting your membership.

If you pass one part and fail the other part, you’ll only need to retake the failed part.

Let me know if you have any other questions.

Hello Sir Good day. I’m from Philippines. I’m planning to take CMA Exam but I just want to clarify something, may I know how is the procedure of the review and how can I take the exam? Thank you.

Hi Cathy,

Check here the CMA exam roadmap to learn everything about how to prepare for and how to take the CMA exam.

If you have any further questions after reading through that post, please let me know. I’ll be happy to help!

which schools offer CMA IN NAIROBI KENYA?

Hi Martha,

I’m not aware of any schools in Kenya, but I recommend you to opt for online CMA review courses as they are generally more established. Check here the pros and cons of online vs classroom learning.

If you have any other questions, please let me know. 🙂

Ok I’m with ur advice.

after registration it is mentioned that we have to complete the exam within 3 years.

That means we can complete the course in 1 or 2 years also???

Yes, but depending on what course you’re enrolled in, your access to study materials may expire after a year or two, so keep that in mind too 🙂

hi nathan, i registered for the cma this may 7th but till now i didnt recieved authorization number to schedule exam date and am planning to attend the exam on june. how long it will take to get the authorisation number after registration ?

Hi Shahid,

The authorization number should have been sent to you immediately after paying the IMA exam fee. If you can’t find it in your SPAM folder, it’s best to reach out directly to IMA to help you with this.

Hi i m from india intetested for cma but after my 10 th pass i didnt do intermediate and did 3 yrs degree course in distance i have 4 yrs accounts exp worked in dubai m i eligible for cma

Hi there – you are eligible for the CMA exam, however you may need to check directly with IMA whether your experience qualifies for the CMA certification.

But keep in mind that you can fulfill the experience requirement either prior to or within 7 years of passing the exam.

I just graduated BS in Management Accounting in one of the prestigious universities in the Philippines. They said I couldn’t take the CPA board exam but there is a CMA exam available for Management Accounting graduates. Can I take the CMA exam even though I just graduated? How? And where? And what are the requirements?

Hi Marie – yes, you absolutely can pursue the CMA designation even though you just graduated.

The first step is to enroll in a CMA review course to help you prepare for the exam.

I recommend you ours because it provides a step-by-step program to help you study more efficiently and unlimited coaching support for you to ask as many questions as you need to fully understand the material.

After you pay the IMA fees (membership fee, CMA entrance fee and exam registration fee) you will receive the Exam Authorization Number that you’ll need in order to schedule your exam appointment with Prometric.

To become certified, you’ll need to complete the following requirements:

* pass both parts of the exam within 3 years of paying the CMA entrance fee,

* maintain your IMA membership (pay the annual fee)

* and complete the experience and education qualifications either prior to or within 7 years after passing the CMA exam.

If you have any further questions, please let me know 🙂

Hyy sir!!!!

Myself priya

Actually I m going to pass my class12th exam nd I decided to pursue cma bt I m lacking with the information about CMA course .

Plz help me ?

Can I do this course just after 12th or I hve to be graduate in any field….

Can u help me!!!! PlZ

I live in Allahabad nd I m not understanding frm where to do this course….. Pls ?suggest me some gud institution for it nd CLG

Hi Priya,

Yes, you absolutely can enroll in a CMA course and sit for the exam before getting a degree.

However, there are education and experience requirements that you need to fulfill in order to become certified after passing the CMA exam.

You’ll need to complete your education and experience qualification either prior to or within 7 years of passing the CMA exam.

To prepare for the exam, I recommend you to enroll in my online CMA coaching course. This course provides a step-by-step 12-week study system that will allow you to follow it without wasting any time figuring out what or how to study, and following it will give you the best preparation possible to pass the exam.

If you have any other questions, please don’t hesitate to reach out.

Sir

I have completed my B.com in May 2017 with 73%. I am really very interested in doing CMA US under IMA. I am from India. Please guide me the procedure i should follow for exam and working experience.

Hi Hetakshi,

I’m glad to hear you’re determined to pursue the CMA designation. Check here the entire roadmap to becoming a CMA.

If you have any further questions, I’m here to help!

HEY!

I HAVE COMPLETED MY GRADUATION (B.COM) .AND I AM QUITE INTERESTED IN CMA!SO WILL YOU PLEASE HELP ME OUT WITH THE PROCEDURES & ALL!

Hi Dimple,

Congrats on your graduation!

Check here the roadmap to becoming a CMA.

To enroll in a coaching course and begin your CMA journey, please click here.

If you have any further questions, please don’t hesitate to reach out.

Is it possible CMA after plus 2 commerce

You’ll need a degree from an accredited university to fulfill the educational requirement. Click here to learn more about this requirement.

Hi Nathan,

I’m planning to study CMA , but my knowledge in accounting is not very good ,is it possible to start studying from ZERO, if yes which book is the best for beginners?

Thanks

Hi Mohammad,

Yes, you can actually start with my CMA coaching course – it is designed for accountants at all levels and I’ve also had students with no prior accounting background who completed the course and passed the exam successfully.

It provides unlimited one-on-one coaching, so that you can ask me as many questions as you need along the course to truly grasp the material and pass the exam with flying colors 🙂

Check my coaching course here.

If you have any other questions, please don’t hesitate to reach out.

I seek a reply please.

I got my CMA 7 years before. I did not want to continue to be a member- I did not comply payment of fees and did not complete CPE.

But now I want letterd CMA used after my name.

How can I do so – without complying any of the requirements. I mean is it legal to call myself CMA( Inactive) or CMA (Retired)?

Please advise, and please do advise the exact page where I find useful information on the Institute’s website. Thanks. .

It’s best to reach out directly to IMA (ima[@]imanet.org) and see whether they can help you in this situation. I don’t want to inadvertently misguide you.

Best of luck!

What are the qualifications for CMA course .time period of CMA course and

Fee structure of course

Hi Ravi,

Please click here to learn all the steps you need to take to become a CMA.

And click here to get to the CMA coaching course.

If you have any further questions, please feel free to reach out.

Hi,

If I don’t have a BA degree, but I have a 5 years experience working in Accounting and I have passed the GMAT exam, Can I apply to the CMA exam ?

Hi Suha,

I recommend you to reach out directly to IMA to check whether they can exempt you from the education requirement, considering your extensive experience in accounting.

Anyhow, keep in mind that the education qualification can also be fulfilled after taking the CMA exam.

Best of luck!

I recently passed both levels of the CMA exam. Am waiting for the IMA to update my status. When that happens will I get a diploma to hang on the wall?

Yes, after they’ve emailed the certification number to you, they will also ship the hard copy of the certificate.

Congrats on becoming a CMA!

do i need internship to be a CMA?

Hi Joshua,

You’ll need two years experience in management accounting and/or financial management, but you can fulfill this requirement either prior to or within 7 years of passing the CMA exam. For more info, please click here.

Cheers!

Hi Nathan

Is it necessary to take up a review course for the preparation of CMA, can we do self study?

Hi Ridhima,

Yes, of course. For that you’ll need to get CMA review textbooks and a test bank to help you assess your knowledge of the subject matter.

You can easily order these study tools here.

Cheers

Hi,

I am planning to appear in CMA Part 1 exam in Feb, 2017. is it possible if I pay IMA Entrance Fee & CMA Examination Fee one month before Exam ?

Hi Faizan,

Yes, it okay to schedule your exam appointment at least 4 weeks in advance of the exam date.

Hi Nathan,

My name is tauseef and I am from india working for nav calculation team in State street financial corporation basically I am from investment banking operations I want to know is cma usa is good choice for me for future endeavour as I am confused with Cpa or cma usa.

Hi Tauseef,

The CMA is geared towards accountants who want to hold managerial positions. Click here to learn more about it.

To hold the CPA it’ll require working for a CPA and in auditing. If you don’t find that appealing then the CMA is the best route to go.

Hi Nathan,

I’m unemployed at the moment. Will I have to take the professional membership or can I opt for the student one.

Thanks,

John

Hi John,

To qualify for Student membership, you must be enrolled in at least six undergraduate or graduate credit hours, or the equivalent, per semester. If you don’t qualify for it, then the Professional membership is the right one for you.

Let me know if you have any other questions.

how can i get entrance in cma

Hi Fyzan,

You can pay the CMA entrance fee on IMA’s website. But first, you’ll need to become an IMA member. Click here to learn more.

How to take admission In CMA after passing 12th commerce and the fee structures in Indian Rupee

Hi Srinivas,

Please, check this link to learn about the exam fees and how to register for the exam.

Let me know if you have any further questions.

Hii sir

So will CMA would help me in my business or starting a new business.and what will be the value CMA in future. According to you after merely 15-20 years.

Hi Shahnawaz,

The knowledge you’ll gain while preparing for the CMA exam will immensely help you grow your business. Click here to find out how the CMA designation can benefit your career and your company.

Hi Nathan,

You had been really helpful whenever I asked any question related to CMA. I am coming up with new problem here: I have cleared Part 1 and in February, 2018 my 3 years of registration will be over and as per CMA rules my cleared part will be expired. Is there any way I can extend this date as I really cant appear for the exam during next 6 months (Have other issues to deal with).

Thanks

Waleed

Hi Waleed,

Please, reach out directly to IMA to check whether they can offer you an extension.

Best of luck!

Thanks for previous reply.

I want to ask that will I able find a job after passing my CMA exams to gain the 24 months work experience for certification.

Hello

I want to know that how we will gain the experience of 2 years .will we be able to get job after passing exams or after completing 2 years experience?

Thank you

Hi Navpreet,

You can fulfill the experience requirement within 7 years prior to or after passing the CMA exam.

Completing the CMA exam will increase your chances of finding a good job, as this will confirm that you have a mastery of the critical skills and knowledge in planning, analysis, control, and decision support.

But you’ll become certified only after submitting the experience and education requirements to IMA.

For more information, please click here.

Best wishes!

Hello,

I have a technical license degree 5years in accounting and auditing also I have 8 years experience as senior accountant.

Is that match the education and experience requirements to get the CMA certification?

Thank you,,

Hi Nancy,

For eligibility it’s best to contact the IMA directly, they have the final say on this.

Cheers!

Hi,

I have two questions:

1) I have construction management degree and working in project management field. will this experience be accounted for CMA?

2) will they provide any completion certificate if i complete the two papers successfuly without experience?

Kindly answer

I hav completed my graduation so how can i enroll for cma n for whch part i can enroll…

Hi Pooja,

Check here the roadmap to becoming a CMA. You should start with the part that is most familiar to you.

To enroll in the CMA Coaching Course, click here.

Let me know if you have any other questions.

Hi,

I have two questions:

1) I have construction management degree and working in project management field. will this experience be accounted for CMA?

2) will they provide any completion certificate if i complete the two papers successfuly without experience?

Kindly answer

Hi Mohamed,

1) Please, reach out to IMA directly to check if your work experience meets their requirements, they have the last word in this.

2) Yes, they will provide a letter showing that you passed the exam.

Let me know if you have any other questions.

Cheers

Hi Nathan,

Can i pass part 1 of the exam in 3 months??

I planned to take it on 31st of October this year.

Hi Ayah,

Absolutely! My coaching course can prepare you for one part of the exam in just 12 weeks.

Hi Sir,

Can i take the CMA here in the philippines?

Hi Karen,

Absolutely! To enroll in an online CMA coaching course click here. You can also locate the nearest test center on Prometric:

http://prometric.com/icma

Let me know if you have any other questions.

What is the scope for B. Tech graduate doing CMA(US)???

The CMA certificate will give you a competitive advantage in the accounting field over non-certified peers.

Check the roadmap to becoming a CMA here to learn more about this designation and how to obtain it.

I M little bit confused related to 2 years of professional experience.i am Bms graduate…I have appeared this year. The question is where is the need of 2 years of professional experience before registration or after clearing cma exams

Hi Arsalan,

You can submit the CMA experience requirement prior to sitting for the CMA exam or within 7 years of completing the exam. To become certified you need to submit both the experience and education requirements to IMA.

Hi Nathan,

Im from Philippines, may i ask if is there any CMA exam located here?

Hi Celyn,

Yes, of course. You can locate them on Prometric.

Let me know if you have any other questions.

Cheers!

what advanced accounting courses would u recommend to help prepare to become a CMA. I feel like I need advanced study from the classroom first.

Actually, preparing for the exam itself is sufficient, especially if you choose a coaching course instead of self-studying.

Here’s a more detailed roadmap to becoming a CMA. And check also my CMA coaching course here.

Let me know if you have any further questions, I’ll be happy to help!

Hi Nathan,

I enrolled for CMA on 24 Sept 2014, appeared for CMA Part 2 exam in Jan 2015 & passed the exam too. Due to some personal reasons i couldn’t continue studies for a while. I am appearing for Part 1 examination in June 2017, my question is just in case if i fail the examination,will I be eligible for another attempt in Sept 2017 or the credit for passed exam will expire and I hv to re-register and appear for both exams.

Hi Soumia,

Technically, you should be allowed to have another shot in September. However, I suggest you to reach out to IMA to check whether they can give you an extension.

Best of luck on your upcoming exam!

Hi Nathan,

My Question is Regarding a Pre-Requisite for taking the exam that you have mentioned. It says that i need to have 2 years of professional experience in Financial management.

I have an engineering background and a post graduation in Construction Management. I was working as project planner. Later on i have started my own company and working on it since 18 months.

I want to clear and get certified in CMA, as it will boost my personal CV and also it would help my company.

With my experience will i be able to take the exam or no?

Hi Rakesh,

For the record, you can fulfill your experience requirement within 7 years of passing the exams in order to become certified, you don’t necessarily need to submit the requirement before the exams.

However, I suggest you to check with IMA directly whether your current experience is relevant for the CMA certification and what you could do at your company so that you experience could count for it.

Wish you best of luck!

Hi Nathan,

I’m from india

I am working as a PO in a Bank.will my this experience count for CMA completion?

Hi Ritika,

Probably not, but you may want to reach out to IMA to confirm this. According to IMA’s CMA handbook, the qualifying experience consists of positions requiring judgments regularly made employing the principles of management accounting and financial management. Such employment includes:

• Preparation of financial statements

• Financial planning & analysis

• Monthly, quarterly, and year end close

• Auditing (external or internal)

• Budget preparation & reporting

• Manage general ledger and balance sheets

• Forecasting

• Company investment decision making

• Costing analysis

• Risk evaluation

It’s worth noting though that you can also fulfill the experience requirement within 7 years of completing the CMA exam.

Best of luck!

Hi Nathan,

I am from India, currently pursuing my CA. I have given CA Final Exams 3 times but I haven’t cleared. I don’t have any professional experience apart from my CA-Articleship. So if I enroll for CMA and clear both exams in next 6 months, would it give me any value addition in finding a job ? ( I mean without 2 years professional experience, just by passing exams)

Moreover, I am not sure about the career path to chose. I am struck between CMA and CFA. So if I want to switch to CFA later in my career, will CMA course have any value addition to my career ?

Hi Avinash,

The CMA is totally worth in your situation because it’ll give you a big advantage over your non-certified peers and will even provide you with the skills to excel in a managerial position down the line.

Even with no work experience in the field you can move to managerial accounting, because passing the CMA exam will prove that you have the knowledge and skills needed.

Also remember that after passing the exam, you have up to 7 years to fulfill the experience requirement to officially be certified.

Im a project manager working in project cost preparatio,budget analysis .cost control.im eligible for cma exam or not???

Yes, you are eligible for the CMA exam. However, to become certified you will need to fulfill the education and experience requirement. You can fulfill them within 7 years after passing the CMA exam.

Hello Mr nathan liao. first of all i really appriciate for the information you have provided. i Am from India currently in the first year of Bachelor of commerce.I am planning to go for CMA. Should i do CMA along with my B.com studies or should i do after my graduation.If i opt of CMA after graduation what will be the duration of CMA course

Thank you, Hamza. And yes, I think that pursuing the CMA as a student is a great idea. Besides paying much lower prices for the membership and exam fees, you’ll learn a lot of practical things that you’ll be able to apply at work and which will facilitate getting you a promotion to a management position.

Depending on which CMA course you choose, it may take you 3 (with a coach) to 6 (self-studying) months to prepare for a single part.

hii Mr.Natham…how are you

i have completed my M.com, MBA and also CA IPCC,,,But i tried hard to clear my CA final….so i would like to enter into CMA…i have strong accounting,,financial management knowledge…there by can i pass cma exam in first attempt if i study daily 5 hours over a period of six months…kindly help me…thank you…..

Hi Mahesh. If you have the the full set of CMA materials and you’re diligent about your studies, then you’ll surely pass the exams on your first attempt.

However, I recommend you to sit for the exams in separate exam windows – it’ll greatly increase your chances of passing them on your first attempt, since it’ll allow you to concentrate on a single part at a time.

If you have any other questions, please let me know.

Hello Sir,

I had a query in my mind..can I appear for both part 1 and part 2 of CMA examination in a single window ? That is ; may/June 2017

Hi Neha. You surely can, but not in the same day. Although, I don’t advise you to, because the exams are really hard and it is better to concentrate on a single part per window to increase your chances of passing the exam. Let me know if you have any further questions.

Hey Nathan,

I am currently perusing my CMA. I have completed BCom and not into any workforce. What should I do to gain professional experience after passing both the parts. I couldn’t get the correct details of this. Can you help me out with that.

Hey Muruganand. You’ll need to find a job to gain the required experience. After passing the CMA exams you’ll have 7 years to complete the experience requirement.

Hy..natan..

Is there any reletionship between icmai and ima about pursuing cma(us) certificate course..?

Hi Amit,

Both institutes have entered into a Memorandum of Understanding (MoU) to enable mutual recognition of the certificates. You can learn more here.

Cheers,

Nathan

Hello,

I am a student of Institute of Chartered Accountants of Bangladesh (ICAB) and have completed 17 papers out of 18. After my A-levels i started with ICAB in 2010 and have not done any graduation. I have professional experience of 7 years.

Can I enroll for CMA and sit for exam for June session? Please let me know whether i am eligible for CMA exam!

Hi Moumita,

Candidates must satisfy one of the following education requirements and submit verification of education to ICMA.You may check your eligibility using the information below:

• Bachelor’s Degree from an accredited college or university. A partial listing of accredited International and US institutions is available at: http://univ.cc/world.php.

• Degrees that are not accredited must be evaluated by an independent agency. A listing of these agencies can be found at http://www.aice-eval.org or

https://www.naces.org/members.

• If you cannot locate your college or university on the accredited listing, please contact [email protected].

Thanks and Regards,

Nathan

Hello,

I’m 41 years old and have limited accounting/finance experience. My experience is about 3 years, can I qualify for the young professional membership?

Hi Rafal,

The Young Professional Membership is only available for professionals who are less than 33 years old. You must register as a professional member.

Thanks and Regards,

Nathan

what is the maximum available time needed to complete my cma program under student membership

Hi Marwan,

My recommended time for studying would be a minimum of 12 weeks per part for both students and working professionals.

Thanks and Regards,

Nathan

Dear nathan,

Do i need to pay again for the ima membership when it expires to take the exam(i knw for exam i need to pay again).

Hi Arh,

Yes, to register for the exam, you need to pay for the IMA membership.

Thanks and Regards,

Nathan

hi Nathan

i am b com holder from india and ca intermediate

i would like to know weather i am eligible or not

Thanks and reagards

Ashikh

Hi Abdhul,

Yes, candidates must satisfy one of the following education requirements and submit verification of education to ICMA.

• Bachelor’s Degree from an accredited college or university. A partial listing of accredited International and US institutions is

available at: http://univ.cc/world.php.

• Degrees that are not accredited must be evaluated by an independent

agency. A listing of these agencies can be found at http://www.aice-eval.org or

http://www.naces.org/members.htm.

• If you cannot locate your college or university on the accredited listing,

please contact [email protected].

Thanks and Regards,

Nathan

hey , i am in faculty of commerce Accounting department , in the third year and i intend to take CMA while am in college so is it possible or i must wait to end my 4 years !!!

Hi Mark,

Yes, it is possible to take the CMA exam as a student but in order to get the CMA certification, you must obtain the 2-year CMA experience requirement within 7 years after passing the exam.

Thanks and Regards,

Nathan

Hi ,

I am doing bcom now.My question is that if i clear the cma exam now and i am not able to get 2 years experience in the next 7 years, should i redo the test again

Hi Albin,

Yes, I think you have to retake the exam again if you fail to comply with the experience requirement within the prescribed period.

Thanks and Regards,

Nathan

Hello, I am CA Inter ( appeared for CA FINAL for thrice but couldn’t clear) Since last 3 years I am in family Business. Is it possible for me to get CMA USA cleared & make career bright & stable ??

Hi Keyur,

The CMA certification will give you a competitive advantage in the accounting field over non-certified peers.

Thanks,

Nathan

what is the procedure to do cma ..what will be the cost estimate? what are the qualification to proceed forward

Hi Anurag,

Please check the link below for more information:

https://www.cmacoach.com/cma-faq/

Thanks,

Nathan

i am just a B.com graduate and MBA finance from Sikkim Manipal University(India). currently i am working with accounts department of a private limited company from last 7 years. can i enroll for CMA exams? how many exams are there?

Hi Rajat,

Yes, you can take the CMA examinations. The exam is composed of two parts. Part 1 is Financial Reporting, Planning, Performance, and Control and Part 2 is Financial Decision Making. Let us know if you have further questions, we will be glad to help you. You may also check our CMA courses using this link.

Thanks,

Nathan

Hello Nathan.

I wanted to ask you that I want to study CMA. But the thing is I don’t have a bachelor’s degree nor I have done ACCA. So could you kindly tell me that can I start CMA?

If I can, then what would be a difference between a normal CMA and a the CMA I would do? Also, would there be a difference in terms of salary. Kindly advise me. Would appreciate it.

Looking forward for your reply.

Hi Moazzam,

Either a bachelor’s degree or a related professional certification is required in pursuing the CMA. For further information, you may visit this link and check the Education Qualification section of the CMA Handbook.

Thanks,

Nathan

My query is regarding CMA certificate validity. Does CMA certificate (After Passing 2 parts Exams) have life long validity, besides its annual renewal of membership in IMA.

I mean if I don’t go for IMA membership, Just want to have CMA passed certificate. Can we do so?

Hi Kumar,

In order to maintain the CMA designation, we have to abide to the IMA’s policy. We have to regularly update (annual) our membership with the IMA.

Thanks and Regards,

Nathan

Hi, I have finished my graduation but the results are awaited. I am not working anywhere as a professional. Please tell me under which category i am eligible to register for the CMA course

Hi Vaibhav,

Yes, you may register under the student membership option. According to IMA,

“To qualify for Student membership, individuals must be enrolled in at least six (6) undergraduate or graduate credit hours, or the equivalent, per semester. Student membership can be held for a maximum of six (6) years. Student members who move to another membership category cannot revert back to Student membership.”

Thanks,

Nathan

Hi i am in my last year of college and about to graduate. As i am eligible for student membership, i was wondering how long is it valid? Is it an one time payment? When do i move to another membership? Thank you.

Hi Indrajit,

Yes, you are eligible as long as you have registered at least 6 units per semester within the expected date of exam.

Thanks and Regards,

Nathan

Dear Mr. Nathan,

Hope your fine and doing well,

If i am ready for Exam now in June can this is passable to get registration and give exam in June?

Hi Shakil,

It is strongly recommended to register within 6 weeks from the date of exam to reasonably assure that everything will be processed on time.

Thanks and Regards,

Nathan

Dear Nathan,

I am a student of CA. It is the requirement of ICAP to complete a full time internship of 3.5 years in an accounting and audit firm.

Will this internship be equal to the professional work requirement of CMA?

Auditing, taxation, accounting and advisory are the main areas where an Intern usually works.

Similarly, since I am a student of another professional body, will I he eligble for the Student Fee structure?

Looking forward to ur kind response.

Regards,

Zuraiz Chaudhary

Hi Zuraiz,

Though internships and trainee programs are a great way to gain valuable experience, they are not considered the same as being a permanent hire in the eyes of the IMA. – See more at: https://www.cmacoach.com/cma-experience-requirement-determine-your-eligibility/

Yes, you may register under the student membership option. According to IMA,

“To qualify for Student membership, individuals must be enrolled in at least six (6) undergraduate or graduate credit hours, or the equivalent, per semester. Student membership can be held for a maximum of six (6) years. Student members who move to another membership category cannot revert back to Student membership.”

Thanks and Regards,

Nathan

When will be the next schedule for CMA examinations this 2020? Can I get discounts since I’m still a student? How much does CMA costs? Thank you!

Hi Judy, the next exam window start on May 1st and ends on July 31st. The last exam window starts on Aug 1st and ends on Oct 31st.

Please use coupon code CMACOACH at checkout for a 15% discount 🙂

Hey brother,

I m from India and now I quite interesting in joining this course. But what if I clear my both parts and after that what can I do? Right now I am in bcom and after passing exam can I go to my post graduation?

Hi Jatin,

To know more abut the CMA certification, you may take a look at the link below:

CMA Handbook

Thanks and Regards,

Nathan

Hi Im Mark

Can I just pay the exam fees and take the exam at scheduled date? Or do i have to pay first the registration for IMA?

Hi Mark,

Yes, you need to register as an IMA member before paying for the CMA entrance and exam fees.

Thanks and Regards,

Nathan

Hi Nathan!

Im from Philippines and some of my friends told me that I should go to either Dubai or Australia to study for the CMA exam. And if I passed the CMA exam in Dubai, per say, I can only use my license in Dubai. Please explain this matter to me further for I am just a mere sophomore college student. Thank you and God Bless!

Hi Raffy,

That’s a myth. You can sit for the CMA (USA) exam in the Philippines via Prometric testing centers located in Metro Manila and Cebu. The CMA (USA) license is recognized worldwide not just in Dubai.

Thanks and Regards,

Nathan

Hi Nathan! I wanna add some questions (slightly connected to Raffy’s) hope you could answer 🙂

I’m a current Grade-11 Senior High School student, and is it possible for me that in my 2nd or 3rd year,soon, in college taking up BS Accountancy , I can start my journey of having CMA certification, to be able to have it as soon as I graduate ? And even if I got it in the Philippines, I still have a chance to work abroad, right? especially in New York, where the Big 4 Accounting Firms are located. It’s my dream.

(IF) But after passing CMA, is it still worth it to take CPA next? or a hassle? Yet I think I can have advantage if I do so . I just can’t and don’t want to do the common way in which I have to study in I’m chosen state to be able to work there (and CPA licensed there too).

I just found out about CMA and lifted up my spirit. Like I don’t actually have to give up my dream or sacrifice money and time studying abroad.

Hi Lovelyn,

1) You can definitely take the CMA exams while still in college. It’s a great idea to graduate and also have passed the CMA exams. It’ll give you an advantage career-wise over your peers who only have a Bachelor’s degree.

2) The CMA is a global designation allowing you to apply for jobs at companies that value the CMA and that may be located outside of your home country.

3) According to IMA’s salary survey, professionals holding the CMA and CPA earn more than those who only have one of these designations. But those who hold the CMA alone earn more than those who only hold the CPA license.

Thanks, Nathan

Do have any cma per paper discounts for the may/june window 2016?

Hello Ali,

Yes we do. You can use coupon code cmacoach to get 5% discount!!

Nathan

Hi, I have a question, i have taken a student membership which is expiring on this April , so if in case i have passed both parts and do not have an accounting experience..is it fine to renew my membership after i get professional experience after completing both parts or do i have to keep renewing until i complete all the CMA requirements which is actually quite expensive. Awaiting a quick reply.

Thanks,

Nishita

Hi Nishita,

There are many benefits to keeping your membership active including monthly publications, free webinars, courses, networking events, etc.

I have worked for 2 years with the Small Business Development Center coaching and consulting small businesses. Much of my work is business planning, financial management and projections, etc. Will this count for experience or does it have to be narrowly full-time in financial management?

Hi Mark,

I believe your experience qualifies but when it comes to experience requirements, I always ask people to contact the IMA directly to get a definitive Yes or No as they make the last call.

hi, iam megha. iam from india. i want to get a job in australia after finishing my exams in cma. is it possible?..

Hi Megha,

The CMA is a global credential that opens job doors to CMAs everywhere. My suggestion is to contact recruiters in Australia to get a better idea on job market and opportunities there.

Hi Nathan! Im jing, im a cpa in the philippines. but we moved here in new york and i would like to have a us cpa license too. but i found your website and got interested in cma certificate too. if my school in the philippines is listed on the accredited list provided in univ.cc./world.php, whats the next step i should do? thank you. i really want to acquire either a cma or cpa license here in the us, thank you so much for the help.

Hi Jing,

Welcome to America 🙂 I hope you are enjoying your stay.

If your school is accredited, the next step is to enroll in CMA Exam Academy, or in any other review course. But in my Academy I’ll walk you step by step on how to prepare and become a CMA.

There are IMA membership and exam fees that need to be paid but most candidates get confused as to when is appropriate to pay them. I’ll walk you through all that in the course. If you choose not to enroll, it’s totally fine. I’m still here to help you succeed in your journey to the CMA designation. Cheers

Hi! I’m Jing Monta, i got my cpa license in the philippines. i plan to take us cpa exam here in the us, but i think i should take additional courses to be eligible for 150 hour req. since i finished my school in other country. i figured out that my school is in the accredited list for cma, using this http://univ.cc/world.php

what’s the next step should i do to be able to sit for the exam? thank you. 🙂 i appreciate your help. really. i really want to have a certification to help me boost my career here in the us.

Hi Jing,

The next step is to choose a review course that’ll help you prepare for the exam. You also need to pay IMA membership and exam fees. What I’ve done is make this whole process easy inside my CMA coaching program. I walk my students step by step on what they need to do to prepare and pass the exam. If you are interested in learning more check it out here.

Hi Nathan,

How can I meet the experience requirement for CMA?

Hi Alisha, you can apply for jobs that will help you meet the requirement or pass the exams and get the experience afterwards.

Hi Nathan, I’m working for Bank, started from junior level and now at Senior Manager position. Will my this experience count for CMA completion.? Also would like to know, will CFA or CMA add more weightage to my career profile in financial institute.

Hi Royan, your experience as a Sr. Manager at your bank will definitely count but if you still have doubts please contact the IMA directly to verify.

Hi Nathan,

Hope you doing well.

You said even after becoming CMA one should pay certain amount to IMA every year in order to retain membership. Could you provide more details on this ?

Hi Shabbir, you can get more information about IMA’s annual membership fee structure here.

I am a current student I have not obtained my BSBA yet but I should in the next year. Do I still begin my journey to be a CMA, or wait until I have my bachelors?

Hi Courtney,

There are more college students who are opting to take the CMA exams before they graduate to get an advantage over non-certified peers. You can take the exam during or after obtaining your degree.

Hi Nathan,

I am a member of IMA from January 2013 and i was planning to take exam but i had some problems so i didn’t take any exams so my Certification Entrance Fee has been expired .

so what should i do if i wanna take an exam or it will be impossible for me ????

Regards

Mohamed Safwat

Senior Financial Accountant

Mohamed,

You will need to renew your IMA membership before taking the exam.

Hi Nathan!! I am from India, I just wanted to know that having this certificate, will it give me the assurance of having a job in USA?

Hi Manisha,

Unfortunately, no credential can provide 100% assurance that you will find a job in the USA. There are too many factors employers consider, but having the CMA will definitely provide you with a competitive advantage over non-certified peers.

Dear Nathan, I am planning to start preparing for CMA from this week onwards. I intend doing this on full time basis, sitting at home. I plan to put in about 6 hours per day. Do you think its realistic to aim at giving both parts at one go by the Oct 2015 exam cycle? Kindly advise.

Rgds,

Chandu

Hi Chandu,

I highly recommend that you take one exam per window. The passing rate is so low for those who self study that you have better odds at passing by focusing on one part per window.

Idont have credit card and i m from india, so cant make payment through debit/credit cards as per bank.

Is there any other way to pay registration fee.plz suggest ASAP as i have to appear in sept/october exam

Rahul,

Do you have paypal?

Hello,

how to meet the experience requirement for CMA? Does getting a Master’s Degree in Accounting meet the experience requirement for CMA?

Alisha, the only way to obtain the work experience is by getting a job in management accounting of financial management.

Hi Nathan,

I want to take CMA part 2 on June 30th, 2015, but I didn’t register the exam yet. How long will it take for the whole process from registration to sit for the exam? I have a degree in accounting and currently in the master’s program. I have 5 weeks, I am not sure if I get enough time to get everything ready for the exam on June 30th.

Thanks.

LeemayP

Hi Leemay, it takes about 3 months to prepare for one part of the exam, 5 weeks is not enough. I would suggest to prepare for the Sept/Oct testing window.

Check out my #1 Online Coaching Program if you are interested in being coached by me.

how long should i Study for part 1 CMA? and how many hours per day? thanks

Aj, you need a total of 3 months per part and about 15 to 20 hours per week.

Check out my #1 Online Coaching Program if you are interested in being coached by me.

Dear Nathan,

Could you please clarify what does the date of entry to the CMA program stand for, I have taken the First exam in Sep 2012 but passed it in June 2013, I am planning to sit for the second part in Sep this year, would my passed part be considered expired?

Thanks in advance

Maher

Maher, you have 3 years to take both parts. You have to take the other part in Sept of this year otherwise you’ll have to re-take it again next year.

Check out my #1 Online Coaching Program if you are interested in being coached by me.

Hi Nathan, thank you for all the information provided in this website.

I just got passed 2 parts of CMA exams. I also graduated from college and found a full time accounting job recently. I don’t expect to handle management accounting function until maybe 2-3 years later. My question is that is there a “deadline” for submitting experience requirement? If there is a “deadline” for submitting experience requirement, usually how many years after the passing date?

Thank you very much for addressing my concerns!

Mark

Hey Mark,

Congrats on passing the exam! Welcome to the CMA gang! 😉

I believe you have up to 5 years to meet the work requirement from the date you passed the second exam. To be sure, please contact the IMA and they will give you a definitive answer.

Hi Mark!

please tell me the review course that you used in reviewing. that would be very helpful for me in finding the right one. thanks

After finsihing my BS in Management Accounting can I take the exam or if ever is it possible to take the exam even if I am not yet a graduate? Thankyou.

Elle,

You would need to buy a review course to prepare for the exam. Although you are majoring in Management Accounting, the CMA is more focused on specific topics so it would be wise to prepare using a CMA review course.

And yes, you can take the exam if you haven’t graduated yet. It’s a great way to get ahead and stand above your peers when looking for a job.

Hi Nathan,

as I’m reviewing all questions and answers here, I have been wondering– could you please recommend a great review course in studying for both parts of the exam?

and also maybe give an example of job titles that is considered in this requirement:

Two continuous years of professional experience in management accounting or financial management.

i would gladly appreciate it. thanks!

Hi Camille,

I have created a CMA coaching course with a step-by-step program which allows my students to follow it without wasting any time figuring out what or how to study. It also includes all the study tools you need to succeed on your CMA exam. Check it here.

For more information about the requirements and the process, please check this more detailed roadmap to becoming a CMA.

If you have any further questions, please don’t hesitate to reach out.

Cheers!

What grade is required on the exam to pass?

What is the grade weighting of the multiple choice versus the essay questions?

Thanks

Greetings,

I hope you are doing well,

What kind of questions will we face? are they multiple choices or essay questions ?

Thanks in advance.

Mohammed,

You’ll have 3 hours to answer multiple-choice questions and 1 hour to answer 2 essay questions.

Do I have to have good grades from school in order to sit the CMA?

Hi Nicky,

Grades are irrelevant to sit the CMA exam. You need a Bachelor’s Degree though.

sir

i was registered in 2009 with ima but i could not appear in exam now i am interested to pass the cma exam what to do because u mentioned about three year of duration. thanks

Khan,

Re-apply for an IMA membership and begin the process over again.

Hello Nathan Sir,